This autumn will be my paternal grandmother's 65th birthday. My father's already got some pretty ambitious plans for her, flying her in first class on Japan Airlines to South Korea to visit her siblings.

However, my grandmother has always wanted to visit Hong Kong, so we arranged to have her fly out of Hong Kong on Cathay Pacific non-stop business class back to New York.

As the plans firmed up, we finally booked her Seoul-Hong Kong flight so that she would spend 3 nights in "Asian New York City."

Of course, booking with cash would mean an expensive one way international ticket. So instead, we looked to our stash of frequent flyer miles.

For 20,000 American Airline miles, we could fly her economy on Cathay Pacific one way. For 30,000 miles, we could fly her in business class. However, we had a better currency to get the same exact award flight - British Airways Avios.

We've been big fans of using BA Avios for select short-haul flights on OneWorld carriers, including American Airlines where we flew to Puerto Rico (2013) and Chicago (2014). Because their award chart was "distance based," flying short flights presented outsized value opportunity relative to "region-based" mileage programs such as American Airlines' AAdvantage.

Outbound Flights

The flight from Seoul Incheon to Hong Kong was 1,284 miles, so a one-way economy flight would cost 10,000 Avios (vs. 20,000 AA miles). Even including cash taxes of $30/person, using Avios was a pretty great deal considering the flight would have cost $434 on Cathay. Implied redemption value came out to 4.0 cents/Avios.

It's important to note that there were also $144 flights on discount carrier Hong Kong Express. However, two concerns: (a) the flight time was inconvenient, arriving mid-afternoon and (b) low-cost Asian airlines haven't had a great safety track record recently. We'll stick with one of the world's best airlines in Cathay Pacific, thank you.

But since my grandmother prefers to travel with family, she invited her sister and brother-in-law to join her in Hong Kong. So my father booked them on the same flight as well, using another 10,000 Avios + $30 cash per person.

Return Flights

The return flight to Seoul was only required for my great-aunt and great-uncle though, since my grandmother was flying back to New York straight from Hong Kong.

However, my grandmother was booked in Cathay Pacific business class, allowing her to fully enjoy the great Hong Kong Airport lounge called The Wing. While not as impressive as the premier First Class section, the Cathay business class lounges included a wide selection of hot and cold food and drink as well as a comfortable place to sit and relax before their flights.

But my grandmother wouldn't abandon her travel companions to enjoy the lounge facilities (accessible only to business class passengers), so my father booked them in business class as well for 20,000 Avios + $23 cash taxes per person.

That same one-way 3hr 40min business class flight retailed for $1,530 per person! However, when calculating redemption values for one-way premium cabin international flights, it's unfair to look at the one-way ticket prices.

Oftentimes, one-way tickets are priced way more than "50% of a roundtrip ticket," and sometimes even just as expensive. So instead, we took 50% of the value of a round-trip ticket, which came out to be $1,365 (which was less than just the one way!).

So using the implied one-way price of $683 per person in business class, the 20,000 Avios were redeemed for 3.3 cents/point, still a great redemption! Just FYI - the same award flight using American Airlines miles would have cost 30,000 miles/person.

Conclusion

By using frequent flyer miles, we were able to book 5 flights for just over $130 total cash outlay. Conservatively, we saved over $2,500 on their flights.

Additionally, by using British Airways Avios instead of American Airline miles, we saved enough frequent flyer miles to put my great-aunt and great-uncle in business class on the way back home.

Besides, American Airline miles are MUCH better used for long-haul premium class flights (such as 14 hours in Japan Airlines First Class or 15 hours in Cathay Pacific Business Class), so we don't want to waste them on short-haul economy flights.

Now, to get the 3 nights of Hong Kong hotels booked...

Showing posts with label British Airways. Show all posts

Showing posts with label British Airways. Show all posts

Monday, August 3, 2015

Grandmother's 65th Birthday Trip

Labels:

British Airways,

Cathay Pacific,

Hong Kong,

Japan Airlines,

Korea

Location:

New York, NY, USA

Thursday, July 16, 2015

Points and Mile Totals

Airlines

American AAdvantage - 600,000 miles

United MileagePlus - 400,000 miles

British Airways Avios - 215,000 miles

Aegean Airlines - 60,000 miles

Hotels

IHG Rewards Club - 113,000 points

Hilton HHonors - 104,000 points

Starwood SPG - 102,000 points

Club Carlson - 18,000 points

Hyatt Gold Passport- 600 points

Bank Rewards

Chase Ultimate Rewards - 392,000 points

Citi Thank You Points - 165,000 points

Now clearly, there are families (and even individuals) out there that have 1,000x more than we do, so we're really not trying to show off. We're just answering a question we get often, and there's no shame/pride here.

The truth is that these points and miles will only decrease in value over time. Programs "devalue" their points from time to time by increasing the prices for award redemptions, so we recommend not hoarding these rebate currencies. Cash you can save, but with loyalty points and miles, you should "earn and burn" as quickly as possible!

Any good redemption ideas for us?

Labels:

Aegean,

American Airlines,

British Airways,

Chase,

Citi,

Club Carlson,

Hilton,

Hyatt,

Intercontinental,

Starwood,

United

Location:

New York, NY, USA

Thursday, January 8, 2015

Best Friend Reunion

So it looks like my family is starting an annual tradition with our best family friends in Chicago. Last winter, we all met at the Wisconsin Dells to enjoy some indoor water park action in the middle of frigid February. This year, we're all getting together in sunny Orlando, Florida!

As I may have mentioned in an earlier post last year, my father's friend Paul started a new residential painting business called Five Star Painting IL.

As a part of being in the painting industry, they attend a big group conference each January. This year, the conference is in Orlando, and they're flying down next week, January 15th.

Because my father simply cannot stand being away from me, my parents and I decided we'd all fly down together. While my father and Paul were in their meetings, my mother and I would be enjoying the hotel pool. Paul, however, was going to come solo, leaving behind my two best friends, Jack and Connor, and their mom, Beth.

Because my father simply cannot stand being away from me, my parents and I decided we'd all fly down together. While my father and Paul were in their meetings, my mother and I would be enjoying the hotel pool. Paul, however, was going to come solo, leaving behind my two best friends, Jack and Connor, and their mom, Beth.

But through the magic of frequent flyer miles, my father was able to find some award availability for Paul's family to join all of us down in Florida.

First, my father searched online to see what it would cost to pay in cash - just to have a benchmark.

First, my father searched online to see what it would cost to pay in cash - just to have a benchmark.

We should note that Paul had bought this exact itinerary back in November for $380/person. Looking a week out, the cash prices for the same flights were a ridiculous $683/person....

...but with they were only going to pay $36/person in cash. Yes, thirty-six dollars! Here's how we did it.

Flight 1 - Chicago to Orlando (on United Airlines)

Beth wanted to fly on the same flight as Paul since she'd otherwise be flying solo with 2 young kids. Since Paul was on a United flight, we looked at using United miles. While there was no Saver level availability (12,500 miles each way), we did find Standard Awards (25,000 miles each way).

So for 50,000 miles + $11.20 taxes + $50 close-in booking fee, we secured 2 seats for Beth and Jack. Connor, being under 2 years of age, could fly free as a lap child. For one way tickets that were going for $427/person ($854 for two), those 50,000 United miles saved $793 total. Not an amazing redemption, but 1.6 cents/mile isn't too bad. Throw in the fact that we were able to assign them Economy+ seating for no additional cost, that was another $100 in additional value received.

Flight 2 - Orlando to Chicago (on American Airlines)

Booking the return flight, we had even better luck. Not only was there award availability, there was Saver level (12,500 American miles each way). However, as you may recall, whenever American has Saver level awards, then you can also book those same exact flights using British Airways Avios (as we did for Chicago 2014 and Puerto Rico 2013).

But remember, the BA Avios program is distance based, not region based. Meaning, American charges the same 12,500 each way for any flight in the domestic US. However, BA Avios charges miles based on the distance, so a 1,005 mile flight costs just 7,500 BA Avios plus $5.60 in taxes per person!

Combining the fact that American Express was having a 40% Bonus for transferring their Membership Rewards into BA Avios, that meant we ended up using just 5,357 Amex MR points per person!

For a one way flight that would cost $256/person, that's a ridiculous 4.8 cents/MR point redemption. Even without the Amex 40% transfer bonus, that would be 3.4 cents/BA Avios. Had we used American Airline miles, then it would have still been a respectable 2.0 cents/AA mile. But of course, that MR transfer was our best option!

Conclusion

Some multiple choice questions to think about...

Flight 1

a. $854 cash for two passengers; or

b. 50,000 United miles + $61.20 cash

Flight 2

a. $512 cash for two passengers; or

b. 10,714 Amex MR points + $11.20 cash

Weather next week

a. New York: 36 degrees

b. Chicago: 21 degrees

c. Orlando: 77 degrees

As I may have mentioned in an earlier post last year, my father's friend Paul started a new residential painting business called Five Star Painting IL.

As a part of being in the painting industry, they attend a big group conference each January. This year, the conference is in Orlando, and they're flying down next week, January 15th.

Because my father simply cannot stand being away from me, my parents and I decided we'd all fly down together. While my father and Paul were in their meetings, my mother and I would be enjoying the hotel pool. Paul, however, was going to come solo, leaving behind my two best friends, Jack and Connor, and their mom, Beth.

Because my father simply cannot stand being away from me, my parents and I decided we'd all fly down together. While my father and Paul were in their meetings, my mother and I would be enjoying the hotel pool. Paul, however, was going to come solo, leaving behind my two best friends, Jack and Connor, and their mom, Beth.But through the magic of frequent flyer miles, my father was able to find some award availability for Paul's family to join all of us down in Florida.

First, my father searched online to see what it would cost to pay in cash - just to have a benchmark.

First, my father searched online to see what it would cost to pay in cash - just to have a benchmark.We should note that Paul had bought this exact itinerary back in November for $380/person. Looking a week out, the cash prices for the same flights were a ridiculous $683/person....

...but with they were only going to pay $36/person in cash. Yes, thirty-six dollars! Here's how we did it.

Flight 1 - Chicago to Orlando (on United Airlines)

Beth wanted to fly on the same flight as Paul since she'd otherwise be flying solo with 2 young kids. Since Paul was on a United flight, we looked at using United miles. While there was no Saver level availability (12,500 miles each way), we did find Standard Awards (25,000 miles each way).

So for 50,000 miles + $11.20 taxes + $50 close-in booking fee, we secured 2 seats for Beth and Jack. Connor, being under 2 years of age, could fly free as a lap child. For one way tickets that were going for $427/person ($854 for two), those 50,000 United miles saved $793 total. Not an amazing redemption, but 1.6 cents/mile isn't too bad. Throw in the fact that we were able to assign them Economy+ seating for no additional cost, that was another $100 in additional value received.

Flight 2 - Orlando to Chicago (on American Airlines)

Booking the return flight, we had even better luck. Not only was there award availability, there was Saver level (12,500 American miles each way). However, as you may recall, whenever American has Saver level awards, then you can also book those same exact flights using British Airways Avios (as we did for Chicago 2014 and Puerto Rico 2013).

But remember, the BA Avios program is distance based, not region based. Meaning, American charges the same 12,500 each way for any flight in the domestic US. However, BA Avios charges miles based on the distance, so a 1,005 mile flight costs just 7,500 BA Avios plus $5.60 in taxes per person!

Combining the fact that American Express was having a 40% Bonus for transferring their Membership Rewards into BA Avios, that meant we ended up using just 5,357 Amex MR points per person!

For a one way flight that would cost $256/person, that's a ridiculous 4.8 cents/MR point redemption. Even without the Amex 40% transfer bonus, that would be 3.4 cents/BA Avios. Had we used American Airline miles, then it would have still been a respectable 2.0 cents/AA mile. But of course, that MR transfer was our best option!

Conclusion

Some multiple choice questions to think about...

Flight 1

a. $854 cash for two passengers; or

b. 50,000 United miles + $61.20 cash

Flight 2

a. $512 cash for two passengers; or

b. 10,714 Amex MR points + $11.20 cash

Weather next week

a. New York: 36 degrees

b. Chicago: 21 degrees

c. Orlando: 77 degrees

Labels:

American Airlines,

British Airways,

Orlando,

United

Location:

New York, NY, USA

Monday, September 15, 2014

Cheap Chicago Weekend

Well, to be completely fair, we didn't actually go into downtown Chicago. We spent 4 days (3 nights) in the Northwest suburbs for my father's small business and to visit my friends Jack & Connor.

Nevertheless, including flights, transportation and hotels, we got through this weekend trip having spent just $143 out of pocket. Here's how we did it.

Taxi

We had to get from our apartment in Manhattan (Flatiron/Chelsea) to LaGuardia at 6AM. LGA Airport is the closest NYC airport and has the shortest security lines, though it also has the least amenities. But to save time and money, we prefer flying out of LGA. We just caught a regular NYC Yellow Cab and it cost us $41 including tolls and tip. Since it was a business trip expense, we put it on my father's Business Starwood American Express.

Cash out of pocket: $41

Flights

From LGA-ORD, we used 7,500 Avios + $5.60 for each one way tickets on American Airlines. We were lucky that the aircraft used was one of American's newer configurations, with a revamped main cabin seat and sleek touch screen in-flight entertainment system. Unfortunately, they charged for most shows and movies, so we just caught up on our sleep.

Our return flight home used the same British Airways Avios redemption scheme. So another 7,500 Avios + $5.60 per person. Unfortunately, the return flight was less than ideal: (a) not on the new aircraft with no entertainment system, (b) we were seated in the very last row, (c) it ended up delayed 2 hours and (d) being 2.5 years old, I had a screaming fit for a good 30 minutes for an unknown reason. But it still cost us just $17 in taxes for 3 passengers.

Cash out of pocket: $34

Hotels

Given my father was just 3 nights away from hitting 2015 Starwood Platinum status, we decided to focus all our hotel stays with them. Fortunately, we had a Sheraton Suites nearby in Elk Grove Village and they had availability to book with points. Thursday and Friday nights were 3,000 and 4,000 SPG points, respectively, for a free night award. So 7,000 SPG points got us 2 free nights with no cash out of pocket. Because my father was a 2014 SPG Platinum elite, we also received (a) 500 SPG points as a welcome gift, (b) free wifi, (c) free access to the Sheraton Club Lounge where we could have complimentary breakfast and evening snacks and soft drinks.

For our final night, we decided to stay closer to O'Hare Airport given we didn't want to be rushed in the morning. So we stayed at another Starwood hotel - Four Points O'Hare in Schiller Park. While not the most glamorous location, behind an office building construction site and BP gas station, it served its purpose of having a clean place to sleep the night before our flight home. For just 3,000 SPG points, we had another free hotel night with (a) 250 SPG as a welcome gift and (b) free wifi internet. The Four Points did not, however, have a lounge for free breakfast in the morning, but they did offer a free airport shuttle every 20 minutes.

Cash out of pocket: $0

Taxis

To get from our friend's place to The Four Points in Schiller Park, we used my father's Uber account. They're currently giving away Free Rides (up to $30) for new sign ups. We weren't entirely sure how much the ride would be, but it ended up being just $23 (including tolls)! By way of comparison, a few months earlier when my father took a regular taxi from ORD Airport to Rolling Meadows (15 miles or about 20 minutes), it ran him about $55 (more than double).

And after we landed in NYC, to get home, we took a regular NYC taxi from the "secret" taxi stand and it ran us another $45 (including tip and toll).

Cash out of pocket: $68

Conclusion

So for a 3 night long weekend vacation/work trip, we only spent $143 in cash in travel (of which $86 for NYC taxi rides to/from LGA Airport). That's just $48/night! Obviously, we spent money on food, but we would have spent that anyway had we stayed at home. But it was a great way to see my best friends for a very reasonable amount of money.

Nevertheless, including flights, transportation and hotels, we got through this weekend trip having spent just $143 out of pocket. Here's how we did it.

Taxi

We had to get from our apartment in Manhattan (Flatiron/Chelsea) to LaGuardia at 6AM. LGA Airport is the closest NYC airport and has the shortest security lines, though it also has the least amenities. But to save time and money, we prefer flying out of LGA. We just caught a regular NYC Yellow Cab and it cost us $41 including tolls and tip. Since it was a business trip expense, we put it on my father's Business Starwood American Express.

Cash out of pocket: $41

Flights

From LGA-ORD, we used 7,500 Avios + $5.60 for each one way tickets on American Airlines. We were lucky that the aircraft used was one of American's newer configurations, with a revamped main cabin seat and sleek touch screen in-flight entertainment system. Unfortunately, they charged for most shows and movies, so we just caught up on our sleep.

Our return flight home used the same British Airways Avios redemption scheme. So another 7,500 Avios + $5.60 per person. Unfortunately, the return flight was less than ideal: (a) not on the new aircraft with no entertainment system, (b) we were seated in the very last row, (c) it ended up delayed 2 hours and (d) being 2.5 years old, I had a screaming fit for a good 30 minutes for an unknown reason. But it still cost us just $17 in taxes for 3 passengers.

Cash out of pocket: $34

Hotels

Given my father was just 3 nights away from hitting 2015 Starwood Platinum status, we decided to focus all our hotel stays with them. Fortunately, we had a Sheraton Suites nearby in Elk Grove Village and they had availability to book with points. Thursday and Friday nights were 3,000 and 4,000 SPG points, respectively, for a free night award. So 7,000 SPG points got us 2 free nights with no cash out of pocket. Because my father was a 2014 SPG Platinum elite, we also received (a) 500 SPG points as a welcome gift, (b) free wifi, (c) free access to the Sheraton Club Lounge where we could have complimentary breakfast and evening snacks and soft drinks.

For our final night, we decided to stay closer to O'Hare Airport given we didn't want to be rushed in the morning. So we stayed at another Starwood hotel - Four Points O'Hare in Schiller Park. While not the most glamorous location, behind an office building construction site and BP gas station, it served its purpose of having a clean place to sleep the night before our flight home. For just 3,000 SPG points, we had another free hotel night with (a) 250 SPG as a welcome gift and (b) free wifi internet. The Four Points did not, however, have a lounge for free breakfast in the morning, but they did offer a free airport shuttle every 20 minutes.

Cash out of pocket: $0

Taxis

To get from our friend's place to The Four Points in Schiller Park, we used my father's Uber account. They're currently giving away Free Rides (up to $30) for new sign ups. We weren't entirely sure how much the ride would be, but it ended up being just $23 (including tolls)! By way of comparison, a few months earlier when my father took a regular taxi from ORD Airport to Rolling Meadows (15 miles or about 20 minutes), it ran him about $55 (more than double).

And after we landed in NYC, to get home, we took a regular NYC taxi from the "secret" taxi stand and it ran us another $45 (including tip and toll).

Cash out of pocket: $68

Conclusion

So for a 3 night long weekend vacation/work trip, we only spent $143 in cash in travel (of which $86 for NYC taxi rides to/from LGA Airport). That's just $48/night! Obviously, we spent money on food, but we would have spent that anyway had we stayed at home. But it was a great way to see my best friends for a very reasonable amount of money.

Labels:

American Airlines,

British Airways,

Chicago,

Friends,

Hotels,

Starwood

Location:

Arlington Heights, IL, USA

Wednesday, September 10, 2014

Chicago for $6/person

Flight #94 – American Airlines 315

New York (LGA) – Chicago (ORD)

Thursday, September 11, 2014

Depart: 7:29AM / Arrive: 8:59AM

Seat: Economy

Earned: 0 miles (733 miles flown)

Cost: 7,500 Avios / person + $6

Regular Price: $160 / person

Mile Redemption: 2.1 cents/mile

Lifetime Miles: 186,217 miles

After a month off, we're finally back traveling. While this is more of a work trip for my father's small business, my mother and I are tagging along to visit our friends Jack & Connor and their parents. Because we're so points/miles heavy these days, we decided to use one of our favorite mile redemptions -- the short-haul flight on American Airlines using British Airways Avios.

Booking

Remember, British Airways Avios is a distance based program. Since NYC-Chicago is about 733 miles apart, this would fall into the 7,500 Avios redemption band for our one-way flight. We only had to pay cash for the associated taxes (about $5.60/person).

Just 83 miles closer and it would have saved us 40%!!! But compared to the typical 12,500 frequent flyer miles it would normally cost on American, United or Delta, we're very thankful to pay only 7,500 Avios and $6 per person.

We did this Avios for AA redemption back in December when we flew NYC-Puerto Rico roundtrip for just 20,000 Avios miles (vs. 35,000 AA miles). My father also "used" this redemption when he was trying to get his lost passport replacement expedited. You can read those other posts if you want the details behind the Avios program and how to redeem them on American Airline flights.

Post-Booking

Now, since my father has his new Citi American Airlines Mastercard, he gets the benefits associated with the credit card on his American flights, including free checked bags and priority boarding, but only when his AA frequent flyer # is on the reservation. But when you make an Avios booking, it automatically puts your BA frequent flyer # on the reservation and AA's website can't update it.

Last time, he still got TSA Pre-Check and priority boarding without having this AA number on the reservation. But just in case, my father went to Finnair's website (a OneWorld partner of American Airlines and British Airways) to find his reservation and update his frequent flyer #. It's important to note that BA has its own reservation code and American has a different one. But to find it on Finnair, you use the BA one.

Now when it came time to selecting seats, my father remembered why he liked having elite status on United. We weren't able to pre-select seats together, and had to pick from a variety of middle seats in different rows. So we picked seats 21B, 22 B and 23B. Since he knew that the airlines alway keeps a few seats together for families traveling together, he knew we'd get re-seated at check in. And worst case, I'm sure someone would give up their aisle/window seat to avoid being seated next to a 2.5 year old sitting by herself.

Conclusion

We were able to get a direct flight on American Airines for a fraction of the miles normally required. So thanks to BA Avios, we're able to spend some quality time with our good friends in Chicago. Unfortunately, this Chicago trip is just a long weekend. In fact, we didn't find great availability on the return back to NYC, so we're flying back home Sunday at 12:30PM. I suppose that will be good for us to get back to our apartment by 4PM, but it would have been nice to spend all day Sunday relaxing with my buddies.

New York (LGA) – Chicago (ORD)

Thursday, September 11, 2014

Depart: 7:29AM / Arrive: 8:59AM

Seat: Economy

Earned: 0 miles (733 miles flown)

Cost: 7,500 Avios / person + $6

Regular Price: $160 / person

Mile Redemption: 2.1 cents/mile

Lifetime Miles: 186,217 miles

After a month off, we're finally back traveling. While this is more of a work trip for my father's small business, my mother and I are tagging along to visit our friends Jack & Connor and their parents. Because we're so points/miles heavy these days, we decided to use one of our favorite mile redemptions -- the short-haul flight on American Airlines using British Airways Avios.

Booking

Remember, British Airways Avios is a distance based program. Since NYC-Chicago is about 733 miles apart, this would fall into the 7,500 Avios redemption band for our one-way flight. We only had to pay cash for the associated taxes (about $5.60/person).

Just 83 miles closer and it would have saved us 40%!!! But compared to the typical 12,500 frequent flyer miles it would normally cost on American, United or Delta, we're very thankful to pay only 7,500 Avios and $6 per person.

We did this Avios for AA redemption back in December when we flew NYC-Puerto Rico roundtrip for just 20,000 Avios miles (vs. 35,000 AA miles). My father also "used" this redemption when he was trying to get his lost passport replacement expedited. You can read those other posts if you want the details behind the Avios program and how to redeem them on American Airline flights.

Post-Booking

Now, since my father has his new Citi American Airlines Mastercard, he gets the benefits associated with the credit card on his American flights, including free checked bags and priority boarding, but only when his AA frequent flyer # is on the reservation. But when you make an Avios booking, it automatically puts your BA frequent flyer # on the reservation and AA's website can't update it.

Last time, he still got TSA Pre-Check and priority boarding without having this AA number on the reservation. But just in case, my father went to Finnair's website (a OneWorld partner of American Airlines and British Airways) to find his reservation and update his frequent flyer #. It's important to note that BA has its own reservation code and American has a different one. But to find it on Finnair, you use the BA one.

Now when it came time to selecting seats, my father remembered why he liked having elite status on United. We weren't able to pre-select seats together, and had to pick from a variety of middle seats in different rows. So we picked seats 21B, 22 B and 23B. Since he knew that the airlines alway keeps a few seats together for families traveling together, he knew we'd get re-seated at check in. And worst case, I'm sure someone would give up their aisle/window seat to avoid being seated next to a 2.5 year old sitting by herself.

Conclusion

We were able to get a direct flight on American Airines for a fraction of the miles normally required. So thanks to BA Avios, we're able to spend some quality time with our good friends in Chicago. Unfortunately, this Chicago trip is just a long weekend. In fact, we didn't find great availability on the return back to NYC, so we're flying back home Sunday at 12:30PM. I suppose that will be good for us to get back to our apartment by 4PM, but it would have been nice to spend all day Sunday relaxing with my buddies.

Labels:

American Airlines,

British Airways,

Chicago,

Friends

Location:

New York, NY, USA

Thursday, January 9, 2014

Points & Miles Status Check

So it's always a good idea to take stock in your points/mile balances to see where you're at with your travel goals. Sometimes you'll realize you need just a few more points from one hotel or airline to achieve your travel award goals. Other times, you'll realize you have more than enough of one kind of "currency" so you'll shift your earning into other types.

My obsessive father likes to check every 2 minutes on his AwardWallet app, but most well-adjusted people probably check a few times a year. I realize that some people have literally millions of points in each category, so clearly we're not trying to show off our modest balances. But since we get some people asking us, I just wanted them to see what can be achieved in a year if you're smart about your work trips, family vacations, personal credit and daily spending.

So as of the beginning of this year, here's where my family stands in our combined reward points & mile balances (and this is after our crazy travel schedule in 2013 when we redeemed a lot of our points):

Airlines

But if you really needed a very conservative approximate $ value for your point totals, you can just assume $0.01 per point across the board to see how much you could redeem these points for (i.e., 294,024 IHG points = $2,940 of potential redemption value). But to be fair having 658 Amex MR is actually worth nothing because it's not enough to redeem for anything. And on the other side of the argument, my family has often been able to get anywhere from 2-5 cents/pt of value from many of our points (Starwood, United). So the only real takeaway is this: "If you can get points for free, might as well take them, because they're worth more than $0."

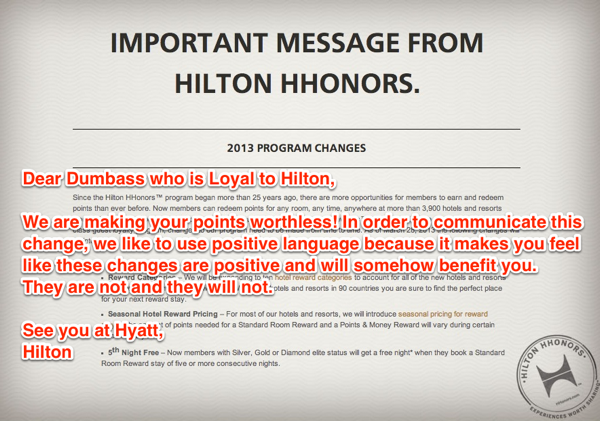

Of course, I have to warn you that at any point in time the Airline or Hotel program can suddenly decide to raise the prices of its free flight / night awards, thereby instantly reducing your precious points to a mere fraction of their prior value.

Such Devaluation, in fact, recently happened for most of these programs over the past few months, including United, Hyatt and especially Hilton (which raised the price of its awards by almost 100% in some cases).

Plus, loyalty reward point "currency" is literally worthless almost anywhere outside the particular program they're in (much like Disney Dollars).

My obsessive father likes to check every 2 minutes on his AwardWallet app, but most well-adjusted people probably check a few times a year. I realize that some people have literally millions of points in each category, so clearly we're not trying to show off our modest balances. But since we get some people asking us, I just wanted them to see what can be achieved in a year if you're smart about your work trips, family vacations, personal credit and daily spending.

So as of the beginning of this year, here's where my family stands in our combined reward points & mile balances (and this is after our crazy travel schedule in 2013 when we redeemed a lot of our points):

Airlines

- United Miles: 144,276 miles

- American Miles: 381,406 miles

- US Airways Miles: 38,920 miles

- British Airways: 121,700 miles

- Aegean Miles: 30,044 miles

- Starwood Points: 167,298 points

- IHG Points: 294,024 points

- Hyatt: 1,519 points

- Hilton: 39,670 points

- Chase Ultimate Rewards: 349,909 points

- Citi Thank You: 208,933 points

- American Express Membership Rewards: 658 points

But if you really needed a very conservative approximate $ value for your point totals, you can just assume $0.01 per point across the board to see how much you could redeem these points for (i.e., 294,024 IHG points = $2,940 of potential redemption value). But to be fair having 658 Amex MR is actually worth nothing because it's not enough to redeem for anything. And on the other side of the argument, my family has often been able to get anywhere from 2-5 cents/pt of value from many of our points (Starwood, United). So the only real takeaway is this: "If you can get points for free, might as well take them, because they're worth more than $0."

Of course, I have to warn you that at any point in time the Airline or Hotel program can suddenly decide to raise the prices of its free flight / night awards, thereby instantly reducing your precious points to a mere fraction of their prior value.

Such Devaluation, in fact, recently happened for most of these programs over the past few months, including United, Hyatt and especially Hilton (which raised the price of its awards by almost 100% in some cases).

Plus, loyalty reward point "currency" is literally worthless almost anywhere outside the particular program they're in (much like Disney Dollars).

Labels:

American Airlines,

Amex,

British Airways,

Chase,

Citi,

Hilton,

Hotels,

Hyatt,

Intercontinental,

Starwood,

Status,

United,

US Airways

Location:

New York, NY, USA

Tuesday, January 7, 2014

Mother's Jan 2014 Credit Card Churn

This past Thursday (January 2, 2014), my father stumbled across a blog post on Personal Finance Digest that discussed a 5% cash back credit card for gas, grocery & drugstore (GGD) transactions.

This past Thursday (January 2, 2014), my father stumbled across a blog post on Personal Finance Digest that discussed a 5% cash back credit card for gas, grocery & drugstore (GGD) transactions.Now, up through February/March 2014, we can continue to earn 5x Thank You points using my father's Citi Thank You Preferred card at GGD (a special promotional offer we received for signing up last February).

But all good things come to an end, and starting in mid-March, we will have to use our regular 1x Rewards Cards to purchase our Vanilla Reload cards at CVS. While this manufactured spending may still be marginally accretive from a points/miles standpoint, we're still paying $3.95 for the 504 points we're earning through this method (a 0.8% transaction fee).

Assuming we're able to actually redeem those 504 points in the future for ~$10 of value (about 2 cents per point), we're going through a lot of work to make a marginal profit of about $6 per Vanilla Reload card. Compared to before, using our 5x Citi Thank You Preferred card (that allows you to redeem at 1.25 cents/pt), we were earning $27.55 of net profit after deducting the $3.95 VR fee.

Assuming we're able to actually redeem those 504 points in the future for ~$10 of value (about 2 cents per point), we're going through a lot of work to make a marginal profit of about $6 per Vanilla Reload card. Compared to before, using our 5x Citi Thank You Preferred card (that allows you to redeem at 1.25 cents/pt), we were earning $27.55 of net profit after deducting the $3.95 VR fee.Fortunately, we won't have to go back to "only" earning $6.13 per Vanilla Reload card because my mother was approved for her new American Express Blue Cash card.

American Express Blue Cash card

This new Blue card will offer her 5% cash back on GGD Eligible purchases* (after first spending an initial $6,500 at 1% cash back each year, all additional GGD purchases that year will earn 5%...forever!).

* Note that the Terms & Conditions state that you only get rewards on Eligible purchases. However, Eligible purchases do NOT include fees or interest charges, balance transfers, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. We'll see what happens.

However, my mother's new Blue Cash card offers unlimited 5% benefits for as long as she owns the card. Since it has no annual fee, it will be a long, long time.

As you can see, it's not as profitable as the Citi Thank You because the Amex Blue Cash card rewards can only be redeemed at 1.0 cent each in the form of statement credits (instead of 1.25 cents/pt), it's still much better than the alternative.

Unfortunately, the Amex Blue Cash rewards won't be as much fun to redeem since they're just statement credits. But money is fungible, so saving $500 on our monthly Blue Amex card statement is ultimately equivalent to receiving $500 worth of airfare or hotel spend for free.

Based on our hypothetical ability to load up $5,000 per month on each of our 4 hypothetical Amex Bluebird cards using Vanilla Reload cards hypothetically bought with our reward credit cards from CVS (and use that to pay off those same credit cards the next month), that's hypothetically $20k of spending each month, or $240,000 each year.

Even assuming this 5x benefit only lasts for 6 months, that's still a hypothetical $120,000 of "spending" which, at 5% rewards, would generate almost $5,800 of hypothetical statement credits. After the fees for each VR card, we're still looking at over $4,800 of hypothetical net profit.

Chase British Airways Visa card

Since my mother applied for one credit card, my father decided she should apply for another card as well since we will need to wait another 3-4 months before the next round of card applications. So she applied for the Chase British Airways Visa card.

While the current promotional offer is just 50,000 BA Avios after spending $2,000 in the first three months, my father was able to find an obscure URL link (click here) that still offered 100,000 BA Avios if you hit some high spending thresholds:

- Initial 50,000 Avios after spending $2,000 within first 3 months

- Additional 25,000 Avios after spending $10,000 within first year

- Another 25,000 Avios after spending another $10,000 that same initial year

- Amazon Payments: $1,000 x 2 parents x 6 months = $12,000

- My Daycare: $340/week x 24 weeks = $8,160

Application Process

My mother applied online for both offers right after one another. Unfortunately, she received a "Decision Pending" on both, but my father was not worried.

The next afternoon, he went online here to check on the status of the Amex application. Without having to speak with anyone or negotiate anything, my mother was approved!

Then we decided to call Chase's Reconsideration Phone Line to see "if there were any additional information we could provide to help our application."

(800) 432-3117 – General Application Status Line, automatedMy mother asked the Customer Service Representative to speak with my father. After answering a few identification verification questions, my mother handed off the phone to my father. He verified the yearly income stated on the application as well as confirmed our status as renters (apartment) and our monthly rent. Then he came back with an offer to approve the British Airways Visa if we shifted some available credit from some of my mother's other 5 Chase cards (4 personal and 1 business). That way, Chase would not increase its total $ credit exposure to my mother. No problem.

(888) 245-0625 – Personal Reconsideration Line with a live rep

(888) 609-7805 – Alternative Personal Reconsideration line with live rep

(888) 871-4649 – Alternative Personal Reconsideration with live rep

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 432-3117 – General Card Services and Application Status, automated

(800) 955-9900 – General Card Services and Application status, automated

Twitter: @ChaseSupport

She was then immediately approved over the phone. Great success! Hmm, now which cards should we apply for next time?

Labels:

Amex,

British Airways,

Chase,

Credit Cards

Location:

New York, NY, USA

Monday, January 6, 2014

Amex Platinum

Yesterday, my parents cancelled each of their American Express Platinum charge cards. You may recall that they applied for the card last January 8, 2013 when there was a limited offer for an incredible 100,000 Amex Membership Rewards sign up bonus.

While 100k MR points is a major haul from 1 credit card application, the Platinum card came with an equally incredible $450 annual fee, not waived the first year! So for two cards (one for each of my parents), that ran $900 in fees alone!

However, through the many benefits offered by this Booty Call Card (a card you get for the benefits, but don't really use for actual spending), we were able to recoup more value than the annual fees cost us. In fact, here's a link to see/enroll in all the benefits for being a Platinum cardholder. In case you're not a link type of person, I will highlight a few for your LCD readers below.

1. $200 in Airline Fee Reimbursement (per calendar year)

If you're good with calendars, which at age 2 I'm still learning, you can actually recoup $400 of value in this single perk alone. This benefit is intended to offset any ancillary airline fees such as checked bags, in-flight drinks, lounge day passes, etc. Of course, my parents having Platinum & Gold elite status with United get many of these benefits for free anyway. While you're not supposed to use this $200 reimbursement for purchasing tickets, there are loopholes (my father LOVES loopholes). Here's how:

My parents received their cards in mid-January 2013. They immediately went online here and selected United Airlines as their preferred airline for this credit. This first step is very important because you will not be reimbursed if your airline is not selected first. Every January 1, you have an opportunity to choose another airline if you want. But otherwise, the default setting will be to retain the same airline as the year before, so no need to re-select if you want to keep your airline constant.

A few weeks later, they each went to United.com and purchased a $200 e-gift certificate to use within the next 5 years for United.com purchases, including flights! (IMPORTANT NOTE: As of December 2013, United Gift Certificate purchases no longer seem to be reimbursed by Amex, per this FlyerTalk thread. Continue reading below to see the next loophole.)

About 2 days later (Jan 17), the $200 charges posted on their American Express accounts. Then 2-3 days after that (Jan 20), their $200 Airline Fee reimbursements posted as well, cancelling out the purchase charges. A free $200 to use on future United flights!

Fast forward 12 months to January 1, 2014. A new year means a new $200 credit becomes available if you still hold the card.

Per the FlyerTalk thread (my father always does his research before), it appeared that GC's were no longer being recognized by Amex as reimbursable. However, the same FlyerTalk thread had reports of users successfully being reimbursed for purchases of Gift Registry credits (kind of like a wedding registry where you can contribute to an account allowing the beneficiary to use as they want), which appears right below Gift Certificate in the drop down menu.

Per the FlyerTalk thread (my father always does his research before), it appeared that GC's were no longer being recognized by Amex as reimbursable. However, the same FlyerTalk thread had reports of users successfully being reimbursed for purchases of Gift Registry credits (kind of like a wedding registry where you can contribute to an account allowing the beneficiary to use as they want), which appears right below Gift Certificate in the drop down menu.

The main difference between a GC and a GR is that the GC lasts for 5 years and can only be used to redeem for flights on United. Additionally, if you have multiple GCs, you can only use a single one per transaction. So since my parents had 2 GC's from 2013, they needed to book at least 2 separate bookings with United to use them. Clearly, it wasn't a problem for us in 2013.

However, multiple Gift Registry contributions can be combined into a single "Travel Bank" account and then used to purchase anything on United.com, including flights on other partner airlines. These features make Gift Registry purchases so much more flexible and easier to use. However, they only last for 2 years (after the most recent transaction), so you may have a shorter time frame to use the $200 in GR value if you let them sit idle.

However, multiple Gift Registry contributions can be combined into a single "Travel Bank" account and then used to purchase anything on United.com, including flights on other partner airlines. These features make Gift Registry purchases so much more flexible and easier to use. However, they only last for 2 years (after the most recent transaction), so you may have a shorter time frame to use the $200 in GR value if you let them sit idle.

So on January 1, 2014, my parents used their Amex Platinum cards to each purchase $200 in Gift Registry contributions and put my father as the beneficiary. So between the two Platinum cards, my father now had $400 in total Gift Registry contributions to use by January 1, 2016.

On January 3, the $200 charges posted to my parents Amex accounts as well as the second year's $450 annual fees. Total balance due of $650 for each Platinum card.

On January 5, the $200 fee reimbursement credit posted to their Amex accounts. Balance due was now $450 each. My father then called that afternoon to American Express customer service and asked to cancel the cards, because he didn't want to pay the next annual fee. The representative made a few counter offers to persuade my father to keeping the card (statement credits, free MR points, etc), but my father didn't find them compelling enough for a second year of $450 in annual fees, so the cards were closed.

On January 6, the $450 in annual fees (2nd year) were removed from the Amex accounts. $0 balance due!

So for timing the purchases of travel credit (in the form of Gift Certificate and Gift Registry contributions), we recouped $400 of value from the first year's $450 annual fee on each card and avoided the second year's $450 annual fee.

2. $100 Global Entry Reimbursement (one-time)

Another benefit of having the American Express Platinum card is having your Global Entry enrollment fee reimbursed. As you may recall, Global Entry is a U.S. program that allows cleared individual travelers to fast track through Airport Immigration when arriving from a foreign country. My father likes to think of it like a VIP line. Here's an account of my personal experience applying/being interviewed for Global Entry as a 1.5 year old child.

The cost to apply is $100, even if you somehow get rejected. However, if accepted, the Global Entry benefit lasts 5 years before having to renew and also makes you eligible for TSA Pre-Check which allows passengers to go through the super fast TSA security line (without having to open your carry-on bags or take off your shoes).

And thanks to American Express, if you use your Platinum card to pay for the enrollment fee, it too will be reimbursed! Another $100 benefit per card!

So now we've received $400 in travel credit for future flights and $100 of Global Entry benefits for $500 of value for each of our Platinum cards.

3. Airport Lounge Access

While this benefit is being reduced starting March 22, 2014, we did benefit from accessing some American Airlines and US Airways lounges during our travels last year. In particular, we used our Platinum cards to get access to the American Airlines Admirals lounges (both JFK and SJU airports) on our recent trip to Puerto Rico. While we would never actually pay $50 / person in cash for the benefit of comfortable seating, better bathroom and complimentary snacks, we still received some amount of value for having our Platinum cards with us.

While American Airlines (and thus US Airways) lounges will no longer participate in this American Express program, Amex is adding new high end Centurion Lounges in select airports across the country. Reports so far are that these Centurion Lounges are amazing (think luxury hotel lobbies), especially compared to the basic spartan offerings of the domestic airlines (think nice waiting rooms at doctor offices).

UPDATE (1/7/14): There have been reports that current Platinum cardholders have been contacted about this future loss of airport lounge benefit and received the following NEW ADDITIONAL benefit starting March 22:

4. Hotel Status Upgrades

Another travel benefit from having the Platinum card is that you can call Amex and upgrade your hotel status with both Starwood (Gold) and Hilton (Gold) for free. While Starwood Gold only gets you upgrades to enhanced rooms (better views), free wifi and late checkout, Hilton Gold also gets you free breakfasts each morning on top of occasional room upgrades, free wifi and late checkout.

While we didn't benefit from these hotel perks ourselves in 2013 (my father already has Starwood top tier Platinum status and Hilton Gold), we were able to gift the Starwood Gold status to friends of ours who didn't have status yet.

5. Regular Amex Benefits

And finally, for having two American Express cards (Platinum or other), we were able to enroll each of them in special Amex promotions including Small Business Saturday ($10 spending credit per card) and the $25 Credit from Amazon ($25 statement credit for spending $75 on Amazon). So another $35 of benefits for each Platinum card, on top of the $500+ from the above items

And finally, for having two American Express cards (Platinum or other), we were able to enroll each of them in special Amex promotions including Small Business Saturday ($10 spending credit per card) and the $25 Credit from Amazon ($25 statement credit for spending $75 on Amazon). So another $35 of benefits for each Platinum card, on top of the $500+ from the above items

Conclusion

2013 Annual Fee Charged = ($450) x 2 = ($900)

2014 Annual Fee Charged = $0 due to card cancellation

2013 United Airline Gift Certificates = $200 x 2 = $400

2014 United Airline Gift Registry = $200 x 2 = $400

2013 Global Entry Reimbursement = $100 x 2 = $200

AA Airport Lounge Access

Hilton & Starwood Gold Status

2013 Small Business Saturday = $10 x 2 = $20

2013 Amazon Discount = $25 x 2 = $50

Total Benefits = $535+ x 2 = $1,070+

Then, we can't forget the 100,000 Membership Reward points we received as a sign on bonus for each card. After hitting the $3,000 of minimum spend on each card, we earned over 206,000 in total Amex MR points, which we ultimately used to help my Aunt and her boyfriend get to Hawaii (by transferring some MR to Hawaiian Airline miles) in July as well as pay for 4 flights to Puerto Rico (by transferring MR to British Airways Avios) this past December - which was clearly over $2,000 of total value.

And we still had a lot of Amex MR points leftover, so we transferred the remaining MR over to British Airways Avios in December before closing our Platinum cards (because we'd lose our the rest of our Amex MR balances when closing the cards out).

While 100k MR points is a major haul from 1 credit card application, the Platinum card came with an equally incredible $450 annual fee, not waived the first year! So for two cards (one for each of my parents), that ran $900 in fees alone!

However, through the many benefits offered by this Booty Call Card (a card you get for the benefits, but don't really use for actual spending), we were able to recoup more value than the annual fees cost us. In fact, here's a link to see/enroll in all the benefits for being a Platinum cardholder. In case you're not a link type of person, I will highlight a few for your LCD readers below.

1. $200 in Airline Fee Reimbursement (per calendar year)

If you're good with calendars, which at age 2 I'm still learning, you can actually recoup $400 of value in this single perk alone. This benefit is intended to offset any ancillary airline fees such as checked bags, in-flight drinks, lounge day passes, etc. Of course, my parents having Platinum & Gold elite status with United get many of these benefits for free anyway. While you're not supposed to use this $200 reimbursement for purchasing tickets, there are loopholes (my father LOVES loopholes). Here's how:

My parents received their cards in mid-January 2013. They immediately went online here and selected United Airlines as their preferred airline for this credit. This first step is very important because you will not be reimbursed if your airline is not selected first. Every January 1, you have an opportunity to choose another airline if you want. But otherwise, the default setting will be to retain the same airline as the year before, so no need to re-select if you want to keep your airline constant.

A few weeks later, they each went to United.com and purchased a $200 e-gift certificate to use within the next 5 years for United.com purchases, including flights! (IMPORTANT NOTE: As of December 2013, United Gift Certificate purchases no longer seem to be reimbursed by Amex, per this FlyerTalk thread. Continue reading below to see the next loophole.)

About 2 days later (Jan 17), the $200 charges posted on their American Express accounts. Then 2-3 days after that (Jan 20), their $200 Airline Fee reimbursements posted as well, cancelling out the purchase charges. A free $200 to use on future United flights!

Fast forward 12 months to January 1, 2014. A new year means a new $200 credit becomes available if you still hold the card.

Per the FlyerTalk thread (my father always does his research before), it appeared that GC's were no longer being recognized by Amex as reimbursable. However, the same FlyerTalk thread had reports of users successfully being reimbursed for purchases of Gift Registry credits (kind of like a wedding registry where you can contribute to an account allowing the beneficiary to use as they want), which appears right below Gift Certificate in the drop down menu.

Per the FlyerTalk thread (my father always does his research before), it appeared that GC's were no longer being recognized by Amex as reimbursable. However, the same FlyerTalk thread had reports of users successfully being reimbursed for purchases of Gift Registry credits (kind of like a wedding registry where you can contribute to an account allowing the beneficiary to use as they want), which appears right below Gift Certificate in the drop down menu.The main difference between a GC and a GR is that the GC lasts for 5 years and can only be used to redeem for flights on United. Additionally, if you have multiple GCs, you can only use a single one per transaction. So since my parents had 2 GC's from 2013, they needed to book at least 2 separate bookings with United to use them. Clearly, it wasn't a problem for us in 2013.

However, multiple Gift Registry contributions can be combined into a single "Travel Bank" account and then used to purchase anything on United.com, including flights on other partner airlines. These features make Gift Registry purchases so much more flexible and easier to use. However, they only last for 2 years (after the most recent transaction), so you may have a shorter time frame to use the $200 in GR value if you let them sit idle.

However, multiple Gift Registry contributions can be combined into a single "Travel Bank" account and then used to purchase anything on United.com, including flights on other partner airlines. These features make Gift Registry purchases so much more flexible and easier to use. However, they only last for 2 years (after the most recent transaction), so you may have a shorter time frame to use the $200 in GR value if you let them sit idle.So on January 1, 2014, my parents used their Amex Platinum cards to each purchase $200 in Gift Registry contributions and put my father as the beneficiary. So between the two Platinum cards, my father now had $400 in total Gift Registry contributions to use by January 1, 2016.

On January 3, the $200 charges posted to my parents Amex accounts as well as the second year's $450 annual fees. Total balance due of $650 for each Platinum card.

On January 5, the $200 fee reimbursement credit posted to their Amex accounts. Balance due was now $450 each. My father then called that afternoon to American Express customer service and asked to cancel the cards, because he didn't want to pay the next annual fee. The representative made a few counter offers to persuade my father to keeping the card (statement credits, free MR points, etc), but my father didn't find them compelling enough for a second year of $450 in annual fees, so the cards were closed.

On January 6, the $450 in annual fees (2nd year) were removed from the Amex accounts. $0 balance due!

So for timing the purchases of travel credit (in the form of Gift Certificate and Gift Registry contributions), we recouped $400 of value from the first year's $450 annual fee on each card and avoided the second year's $450 annual fee.

2. $100 Global Entry Reimbursement (one-time)

Another benefit of having the American Express Platinum card is having your Global Entry enrollment fee reimbursed. As you may recall, Global Entry is a U.S. program that allows cleared individual travelers to fast track through Airport Immigration when arriving from a foreign country. My father likes to think of it like a VIP line. Here's an account of my personal experience applying/being interviewed for Global Entry as a 1.5 year old child.

The cost to apply is $100, even if you somehow get rejected. However, if accepted, the Global Entry benefit lasts 5 years before having to renew and also makes you eligible for TSA Pre-Check which allows passengers to go through the super fast TSA security line (without having to open your carry-on bags or take off your shoes).

And thanks to American Express, if you use your Platinum card to pay for the enrollment fee, it too will be reimbursed! Another $100 benefit per card!

So now we've received $400 in travel credit for future flights and $100 of Global Entry benefits for $500 of value for each of our Platinum cards.

3. Airport Lounge Access

While this benefit is being reduced starting March 22, 2014, we did benefit from accessing some American Airlines and US Airways lounges during our travels last year. In particular, we used our Platinum cards to get access to the American Airlines Admirals lounges (both JFK and SJU airports) on our recent trip to Puerto Rico. While we would never actually pay $50 / person in cash for the benefit of comfortable seating, better bathroom and complimentary snacks, we still received some amount of value for having our Platinum cards with us.

While American Airlines (and thus US Airways) lounges will no longer participate in this American Express program, Amex is adding new high end Centurion Lounges in select airports across the country. Reports so far are that these Centurion Lounges are amazing (think luxury hotel lobbies), especially compared to the basic spartan offerings of the domestic airlines (think nice waiting rooms at doctor offices).

UPDATE (1/7/14): There have been reports that current Platinum cardholders have been contacted about this future loss of airport lounge benefit and received the following NEW ADDITIONAL benefit starting March 22:

As of March 22, 2014, Platinum Card Members will no longer receive complimentary access to American Airlines® Admirals Club lounges and US Airways® Club locations.

We recognize the inconvenience this may cause you as someone who travels frequently, so we have included you in a special offer. You will receive up to $200 in statement credits toward American Airlines and US Airways incidental fees charged to your Card from March 22, 2014 to December 31, 2014.

You can use these credits toward:

- Membership fees in the Admirals Club program and US Airways Club

- One-day passes to Admirals Club lounges and US Airways Clubs

- Other American Airlines and US Airways incidental fees like baggage fees or flight change fees

There’s no enrollment required, and purchases made by both the Basic and Additional Card Members on the Card account are eligible for the promotion. These statement credits are in addition to the $200 Airline Fee Credit benefit already included in your Membership.Had we kept our Platinum cards for another year, perhaps we could have earned another $200 each in AA gift certificates from their "other" category. However, I can't vouch for this tactic, though, so keep in mind that your individual results may vary.

4. Hotel Status Upgrades

Another travel benefit from having the Platinum card is that you can call Amex and upgrade your hotel status with both Starwood (Gold) and Hilton (Gold) for free. While Starwood Gold only gets you upgrades to enhanced rooms (better views), free wifi and late checkout, Hilton Gold also gets you free breakfasts each morning on top of occasional room upgrades, free wifi and late checkout.

While we didn't benefit from these hotel perks ourselves in 2013 (my father already has Starwood top tier Platinum status and Hilton Gold), we were able to gift the Starwood Gold status to friends of ours who didn't have status yet.

5. Regular Amex Benefits

And finally, for having two American Express cards (Platinum or other), we were able to enroll each of them in special Amex promotions including Small Business Saturday ($10 spending credit per card) and the $25 Credit from Amazon ($25 statement credit for spending $75 on Amazon). So another $35 of benefits for each Platinum card, on top of the $500+ from the above items

And finally, for having two American Express cards (Platinum or other), we were able to enroll each of them in special Amex promotions including Small Business Saturday ($10 spending credit per card) and the $25 Credit from Amazon ($25 statement credit for spending $75 on Amazon). So another $35 of benefits for each Platinum card, on top of the $500+ from the above itemsConclusion

2013 Annual Fee Charged = ($450) x 2 = ($900)

2014 Annual Fee Charged = $0 due to card cancellation

2013 United Airline Gift Certificates = $200 x 2 = $400

2014 United Airline Gift Registry = $200 x 2 = $400

2013 Global Entry Reimbursement = $100 x 2 = $200

AA Airport Lounge Access

Hilton & Starwood Gold Status

2013 Small Business Saturday = $10 x 2 = $20

2013 Amazon Discount = $25 x 2 = $50

Total Benefits = $535+ x 2 = $1,070+

Then, we can't forget the 100,000 Membership Reward points we received as a sign on bonus for each card. After hitting the $3,000 of minimum spend on each card, we earned over 206,000 in total Amex MR points, which we ultimately used to help my Aunt and her boyfriend get to Hawaii (by transferring some MR to Hawaiian Airline miles) in July as well as pay for 4 flights to Puerto Rico (by transferring MR to British Airways Avios) this past December - which was clearly over $2,000 of total value.

And we still had a lot of Amex MR points leftover, so we transferred the remaining MR over to British Airways Avios in December before closing our Platinum cards (because we'd lose our the rest of our Amex MR balances when closing the cards out).

Labels:

American Airlines,

Amex,

British Airways,

Credit Cards,

Hawaiian,

Puerto Rico,

United

Location:

New York, NY, USA

Tuesday, December 31, 2013

2013 Travel Year In Review

Well, it's the last day of 2013, and wow, I've had an amazing year. Since my father's an Asian math nerd, according to his excel spreadsheet, I have:

1. Flown approximately 84,860 miles this year.

2. Taken 48 flight segments (14 of which were 5-13 hours long).

3. Flown out of 32 airports.

4. On 12 different airlines.

5. Traveled to 10 foreign countries.

6. Earned 0 frequent flyer miles!

Of course, our #1 airline this year was United Airlines (14 flight segments), and we flew through Newark and JFK Airports most often (9 times each). My father earned United Gold Status and Aegean Airlines Blue Status for 2014, while my mother earned Aegean Airlines Gold Status and United Silver Status through 2014.

Most of our flights were paid for with out of pocket cash, though we did:

On the hotel side, we have:

.JPG)

1. Stayed 129 nights in hotels this year

2. Across 34 different cities

3. In 21 unique hotel brands

The hotel brands with the most stays was a tie between #1T Sheraton and #1T Hyatt Place (15 nights each) followed by #3 Westin (14 nights) and the #4T W Hotels (12 nights) and #4T Park Hyatt (12 nights, including the amazing Palacio Duhau Park Hyatt Buenos Aires seen here). This year we earned Starwood Platinum Status (50 nights) for 2014 and benefited from Hyatt Diamond Status (ending Feb 2014), Hilton Gold Status and Marriott Gold Status.

Now, while many of you may just assume we're millionaires, let me be clear - we are not! Because of the crafty use of hotel branded credit cards, sign up bonuses and seasonal promotions, we've been able limit the out of pocket cash expenditures. From the 129 nights spent in hotels this year, 28 of those nights were for work related travel and reimbursed ($5,060 spent for an average of $181/night). The remaining 101 nights were for "leisure" travel and cost us an average of $83/night in out of pocket cash from using free night awards and Cash & Point discounted rates.

A quick recap of some of our favorite photos from 2013.

1. Flown approximately 84,860 miles this year.

2. Taken 48 flight segments (14 of which were 5-13 hours long).

3. Flown out of 32 airports.

4. On 12 different airlines.

5. Traveled to 10 foreign countries.

6. Earned 0 frequent flyer miles!

Of course, our #1 airline this year was United Airlines (14 flight segments), and we flew through Newark and JFK Airports most often (9 times each). My father earned United Gold Status and Aegean Airlines Blue Status for 2014, while my mother earned Aegean Airlines Gold Status and United Silver Status through 2014.

Most of our flights were paid for with out of pocket cash, though we did:

- Save on my fare since I flew as a lap child for most of 2013;

- Save $1,721 by using our Citi Thank You points for free flights to LA, Memphis and Phoenix;

- Save another $1,348 by using British Airways Avios miles for our recent trip to Puerto Rico;

- Taking advantage of mistake fares, such as the time we flew to Argentina on TAM for just $400/person (vs. $1,200/person normally); and

- Capitalize on United MileagePlus Awards for some of our long haul international business class flights (Thailand, Germany/France and Israel).

On the hotel side, we have:

.JPG)

1. Stayed 129 nights in hotels this year

2. Across 34 different cities

3. In 21 unique hotel brands

The hotel brands with the most stays was a tie between #1T Sheraton and #1T Hyatt Place (15 nights each) followed by #3 Westin (14 nights) and the #4T W Hotels (12 nights) and #4T Park Hyatt (12 nights, including the amazing Palacio Duhau Park Hyatt Buenos Aires seen here). This year we earned Starwood Platinum Status (50 nights) for 2014 and benefited from Hyatt Diamond Status (ending Feb 2014), Hilton Gold Status and Marriott Gold Status.

Now, while many of you may just assume we're millionaires, let me be clear - we are not! Because of the crafty use of hotel branded credit cards, sign up bonuses and seasonal promotions, we've been able limit the out of pocket cash expenditures. From the 129 nights spent in hotels this year, 28 of those nights were for work related travel and reimbursed ($5,060 spent for an average of $181/night). The remaining 101 nights were for "leisure" travel and cost us an average of $83/night in out of pocket cash from using free night awards and Cash & Point discounted rates.

A quick recap of some of our favorite photos from 2013.

Labels:

Air Canada,

American Airlines,

Asiana,

BangkokAir,

British Airways,

Hilton,

Hyatt,

Intercontinental,

LAN,

Lufthansa,

Marriott,

Starwood,

TAM,

Thai,

United,

US Airways,

Vieques Air Link

Location:

New York, NY, USA

Subscribe to:

Posts (Atom)

.JPG)

.JPG)

.JPG)

.JPG)