Last year, my father called up his favorite banks and asked if there were any offers to compel him to keep their credit cards open for another year. After all, spending $65-95 every year for each premium credit card can start to add up... especially when we have 30+ cards. So either (a) the banks will have to give him more than that in value each year or (b) will have to waive the fee.

Some cards that we will keep open forever include the Starwood American Express cards (as it helps us re-qualify for Starwood Platinum status each year, offers 2x on Starwood spend and has great Amex promotions) and United Select Visa (as it helps my father re-qualify for United Gold status each year and offers 3x on United spend).

But coincidentally, these were the ones we threatened to cancel last year in the hopes to receive an attractive retention offer. Recall that last year, my father received 2,000 SPG points in exchange for paying the $65 annual fee for his SPG Amex and an additional 5,000 United miles for paying the $95 annual fee for his United Select Visa.

But every year is different.

This time around, my father called Amex and asked to be transferred to an Amex Retention Specialist. My father said he was doing some planning for which credit cards to use and which to cancel for 2015, then asked if there were any upcoming Amex promotions he should know about. Unfortunately, he was told that since he received a promotional offer last year, he was ineligible for another one this year. No harm, no foul.

He did, however, fare better with Chase when he called to inquire about his United Select Visa. This front line customer service representative was authorized to offer my father a $100 statement credit if he kept his card open another year. That would more than offset the $95 annual fee, so he was actually being paid $5 to keep the card. This offer was on top of the regular 5,000 United miles that he receives each year anyway.

Then another day, we called for my mother's Chase British Airways Visa. We signed up a year ago when they were offering 100,000 BA Avios for spending $20k in the first 12 months. We used those BA miles to fly us to Chicago last year and to fly our friends to Orlando last week. When we discussed waiving the annual fee, they told us it wasn't an option. So we told them we'd like to close the account. Then came an offer to give us 9,000 Avios for spending $1,500 in the next three months. That comes out to 6x vs. the usual 1.25x per dollar spent.

So my father accepted that offer and kept the card open. We quickly found a way to spend $1,500 in a few transactions that week and now are awaiting the bonus to post in the Feb 1st statement. Even though we receive the bonus, we'll still close the card afterwards, since the bonus was only contingent upon spending $1,500 on the card and not paying the $95 annual fee.

We still have to call Citi (for my mother's American Airlines Amex) and Barlcays (for my father's US Airways Mastercard), but we'd be OK with closing those down if no compelling offers are made.

[UPDATE: For my mothers American Airlines Amex, we were given a $95 statement credit if we made a $95 purchase, which was actually $10 more than the $85 annual fee. For my father's US Airways Mastercard, they refunded him $89 for the annual fee, though he was only charged $44.50 for the annual fee.]

Showing posts with label US Airways. Show all posts

Showing posts with label US Airways. Show all posts

Tuesday, January 20, 2015

Retention Year 2

Labels:

American Airlines,

Amex,

Barclays,

Chase,

Citi,

Credit Cards,

Starwood,

United,

US Airways

Monday, June 16, 2014

Need Ideas To Spend Our American Airline Miles

As most of you LCD readers know, my family is pretty loyal to United Airlines. That being said, we do keep up to date with what goes on in the industry - such as the American-US Airways merger.

As most of you LCD readers know, my family is pretty loyal to United Airlines. That being said, we do keep up to date with what goes on in the industry - such as the American-US Airways merger.The reason we care about the merger is because in addition to the United miles we have earned, my family also has over 480,000 AA + US miles combined. That's enough for 3 round trip flights almost anywhere in the world all in FIRST class on any airline in the OneWorld Alliance, including Cathay Pacific, British Airways, LAN and Qantas as well as some codeshare partners such as Ethiad.

If you're not that familiar with the difference between business class and first class, then let's take a moment to clear things up a bit.

When Americans fly domestically in "first class," the seat and experience are probably closer to what international flights would consider business class. Domestic first class passengers get a marginally larger seat that reclines a bit more, additional leg room and an in-flight meal with free alcoholic beverages (beer, house wine, mid-tier spirits).

Perhaps they even get a shorter line to wait at check-in and at TSA security, but everything will basically look and feel exactly the same as the economy check in and security lines. This domestic "first class" is NOT what we're talking about here.

True international first class starts from the moment you arrive at the airport. Many of the foreign airlines have radically unique first class check in areas; some even with completely standalone first class terminals that look more like hotels than airports. Even further, some of the Middle Eastern airlines also offer their first class passengers a free chauffeured ride from their hotel/home to the airport.

True international first class starts from the moment you arrive at the airport. Many of the foreign airlines have radically unique first class check in areas; some even with completely standalone first class terminals that look more like hotels than airports. Even further, some of the Middle Eastern airlines also offer their first class passengers a free chauffeured ride from their hotel/home to the airport.Then after you check in, you head over to the First Class Lounge where you have access to higher end meal options, including a proper dining area that looks more like a restaurant. Again, think luxury hotel level features and amenities. For a detailed review of the world's best First Class Airport Lounges, check out OneMileAtATime's posts (Lufthansa in Frankfurt, Emirates in Dubai, Air France in Paris, Ethiad in Abu Dhabi, and Thai Airways in Bangkok).

And that is all before you're personally escorted onto the plane as the very last passengers to board. The entire flight will wait for you.

And since you don't need to secure your shared overhead space for your carry on, you can avoid fighting your way onto the plane with the "gate lice" who can't seem to comprehend the concept of a line.

And since you don't need to secure your shared overhead space for your carry on, you can avoid fighting your way onto the plane with the "gate lice" who can't seem to comprehend the concept of a line.Then when you board, you are personally identified by the first class cabin crew (usually the highest performing staff) who is staffed at a much more favorable crew-to-passenger ratio than in the other cabins. In fact, out of the 8-12 first class seats on a flight, there's a strong chance that only 2-4 of the seats will be taken so you may be outnumbered by the first class crew.

Then we get to the difference in seats. As you can see in the photo on the left, the Cathay Pacific business class seats are plenty comfortable. But when you see the Cathay Pacific first class cabin on the right, you can see that a single first class seat can actually fit two full-sized adults comfortably.

Now this is literally the definition of a first class problem, but the seats are set up to give a single passenger as much space as possible. That'd be great for the solo business traveler, but probably less so for a family with a young (but adorable) toddler. Somehow, I think if my parents and I were lucky enough to score 3 seats in first class, we would find a way to make it work.

So where should we go in 2015? We could try for Qantas to Sydney...

So where should we go in 2015? We could try for Qantas to Sydney...Or Ethiad to the Maldives...

Or British Airways to Dubrovnik...

Or Cathay Pacific to Boracay...

Or LAN to Rio de Janiero...

So many great choices! Now we just need to find some vacation time from Five Star Painting IL.

Labels:

American Airlines,

US Airways

Location:

Хайфа, Израиль

Tuesday, February 4, 2014

Retention Offers

It's February 2014 and my family has now been playing this travel reward credit card game for the past two years. And even at 2 years old, I have been benefiting from their financial discipline and resourcefulness.

Big warning! If you have any outstanding debt at all (student loans, credit card, personal loans or mob gambling debt), then you're better off not opening more credit cards, because you're probably spending more than you're making and ruining your future. The interest charges alone will destroy any point/mile value you may receive. The last thing you need is another credit card.

While the miles/points game can allow an ordinary person to stretch their limited dollars to travel well beyond their usual means, it is definitely not a "free" game to play. For example:

1. Round trip business class flights to Europe this summer using United miles still cost us $163/person in taxes (vs. retail $4,000+/person).

2. 6 night stay at the Conrad Koh Samui in Thailand was all on Hilton points, but we still had to pay overpriced hotel prices for our daily meals on the property which came out to about $25/person per meal (vs. retail $850/night x 6 nights for the room).

3. Having over 20 active credit cards currently open that all offered a lucrative sign up bonus (50,000-100,000 miles/points) as well as bonus spending categories (2x-5x per dollar charged) gets us a lot of loyalty program currency, but many of these cards also charge $95+ annual fees after the 1st year. Assuming half of our cards have annual fees, that's ~$950 in fees for the privilege of using them for another 12 months.

Of course, there's not much my father can do about the cash cost for #1 and #2, but he can mitigate much of #3 by just getting a hold of the Credit Card Retention representatives.

There's a lot of discussion in the blogosphere about credit card Sign Ups. That's primarily because the bloggers get paid by the credit card companies to get people to sign up for their cards. Not me of course - I'm only 2 years old. I only talk about the cards that my parents sign up for and/or use for illustrative purposes. I don't really care if you get a card or not.

There's a lot of discussion in the blogosphere about credit card Sign Ups. That's primarily because the bloggers get paid by the credit card companies to get people to sign up for their cards. Not me of course - I'm only 2 years old. I only talk about the cards that my parents sign up for and/or use for illustrative purposes. I don't really care if you get a card or not.

But while there's a lot of public attention around the card sign up, there's little said about the other end of the spectrum - the card cancellation. This end is where my father's OCD nature gets us the proverbial "second bite at the apple."

February 2014 Cancellations

Last February, my parents had their Credit Card Churn (signing up for a lot of credit cards at the same time).

A. Starwood Preferred Guest Amex ($65 annual fee)

If you've been reading LCD for a while, you'll know that this card is my father's all time favorite. He uses this for all his non-bonus spending (anyplace where he would only earn 1x points). It's really the only way to accumulate a significant number of SPG points, because actually staying a night at a Starwood hotel doesn't get you that many points.

He's had this card since 2009 and has been paying the $65 annual fee since 2010 (after his 1st year). For him, it's been worth it because he accumulates SPG points, gets 2 stays/5 night credit towards his SPG elite status each year and is an American Express card. As you may know, Amex often runs several amazing promotions each year (such as Small Business Saturday) that will save you significant money, especially since the promotions are available to each unique Amex card (even if the cards are authorized users under the 1 master account). Since we have 3 authorized users under my father's account, we get the promotional benefit 3x, even though we pay just one $65 annual fee.

But on February 2, the 2014 annual fee posted to his account. While he had NO real intentional of cancelling the card, he called the number on the back of his SPG Amex and got an account representative.

Father: "I just got charged the $65 annual fee. I'm not sure I'll use the card enough this year to be worth the fee. I think I'd like to cancel."

Rep: "I see, well, you've had the card since 2009 and you've been using it quite actively. Let me transfer you to our account specialist who can see what they can do for you."

Specialist: "Sir, this is one of the best cards for earning points and miles. It's the only card that allows you to transfer points to both American Airlines and Delta at a 1:1 ratio. And also, if you transfer in increments of 20,000 points, you get an additional 5,000 miles, which is a 1.25x ratio."

Father: "I understand, but I'm not sure that's worth paying the annual fee for. I've actually been using other cards that offer me better bonuses (like 2x) on my spending."

Specialist: "Sir, I'd hate to lose your business. I can offer you a $25 statement credit to partially offset the fee."

Father: "Um, I'm not sure that's of interest to me. Is there anything else you can offer?"

Specialist: "Well, Starwood allows you to buy SPG points. $35 for 1,000 SPG points. Instead of the $25 statement credit, I can offer you 2,000 SPG points, which would be $70 if you purchased them yourself."

Father: "Wait, to be clear, are you offering me the ability to pay $70 for 2,000 SPG points?"

Specialist: "No, sir. Of course you could always just do that yourself if you wanted, the 2,000 points would be a gift for keeping the card another year."

Father: "And paying the $65 annual fee."

Specialist: "Yes, sir."

Father: (deliberate long pause) "OK, I'll take that offer."

So for a credit card that he planned to pay $65 for and keep another year anyway, he received a bonus 2,000 SPG points, which are worth $50-70 to us based on our usual 2.5-3.5 cents/pt redemption history.

B. Chase United Select ($95 annual fee)

This card was another of my father's long time favorites (since 2009). In addition to earning 3x United miles on United.com purchases, it also earned him 1x Premier Qualifying Miles (PQM) up to $5,000 on United.com purchases. Many times, this extra perk of 5,000 PQM was the difference between getting to that next tier of status (Platinum in 2013 and Gold in 2014). Plus, it earns 2x on gas, groceries and restaurants and already comes with an automatic 5,000 United mile annual bonus each year you keep the card. And the fact that this card is no longer offered anymore makes it all that much more special to my father.

So under no circumstances would he ever cancel this card. However, we wanted to see if he'd be offered a retention bonus as well, so he played a little game of credit card chicken.

Father: "I just got charged the $95 annual fee. I'd like to cancel."

Rep: "I see, well, you have an outstanding balance of $XXX. Let me transfer you to a specialist."

Specialist: "Sir, I understand you'd like to close the account. I just want to remind you that this card is a great one for earning United miles. We don't offer this card anymore. As you know, you can 3x on United purchases as well as 2x on gas, groceries, home improvement stores. It also comes with 5,000 annual bonus miles which we've already sent to your account. In fact, this past statement you've earned over 24,000 United miles."

Father: "I understand, but I've been starting to use other cards for my travel spending, including many of your own Chase cards like the Sapphire Preferred"

Specialist: "Wow, yes, I see that you have several cards with us. Well, we'd hate to close your account so perhaps I can look in my system to see what promotions you're eligible for... I can offer you 2 additional United Club passes good for 6 months."

Father: "Um, I actually already have United club access for being a United frequent flyer. Is there anything else you can offer?"

Specialist: "Well, I can offer you an additional 5,000 United miles. If you wanted to purchase that yourself, it would be well over $100 cost."

Father: (deliberate long pause) "Wow, OK. That's very generous. I'll take that offer."

So for another card that he was already willing to pay the $95 fee for, he received another free 5,000 United miles, worth about $100 to us, especially since my father's United account was wiped out after our redemption last week.

C. Citi American Airlines American Express ($95 annual fee)

Unlike the first two, this card was completely expendable after we earned 50,000 American Airline miles for the initial sign up a year ago. This card was my mother's account, and my father already had one in his account. So no need for duplicate benefits (free checked bags, priority boarding) for the same airline that we hardly fly anyway.

Unlike the first two, this card was completely expendable after we earned 50,000 American Airline miles for the initial sign up a year ago. This card was my mother's account, and my father already had one in his account. So no need for duplicate benefits (free checked bags, priority boarding) for the same airline that we hardly fly anyway.

Of course, we'd gladly keep the card if the $95 fee were waived or we received an offer worth more than the fee. Since we don't really fly American Airlines, it's hard to keep my mother's AAdvantage account active without doing something excessive (buying something we don't need or donating miles). Otherwise, after 18 months of inactivity, the account closes and the miles are wiped out. But spending a bit on the card every so often adds miles to her AAdvantage account and resets the expiration date by another 18 months.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee. I'd like to close the account before the fee hits."

Rep: "I see, well, you have 30 days after the fee actually posts to cancel without paying it, but let me transfer you to a specialist."

Specialist: "Sir, I understand you'd like to close the account. [insert review of the card benefits here] "

Father: "I understand, but I'm not sure I want to pay another $95 annual fee."

Specialist: "Well, let me see what promotions we're offering. I can offer you a 2 part promotion. First, we give you a $95 statement credit which will offset the fee, but you have to still pay the fee normally. The statement credit will automatically be processed. Second, there's a special bonus offer for an extra 1,000 AA miles for each month that you spend at least $1,000 for the next 16 billing statements."

Father: "So what happens if I spend $1,000 in March, but then the $95 statement credit posts, bringing my total below $1,000."

The Specialist repeated the original terms verbatim, but didn't actually answer the question. After 2 iterations, she finally understood.

Specialist: "Oh I see, well, you'd still get the 1,000 mile bonus" (but she sounded very uncertain)

Father: "Well, OK. I'll take that offer."

Since there was a $95 statement credit to offset the fee, keeping the card for another year was a no brainer. It gave my mother an easy way to keep her AAdvantage account active as well as retained a lot of Available Credit with Citi, so that we could use it as leverage to trade in when we applied for future Citi cards. The fact that we'd essentially earn 2x AA miles for $1,000 of spending each month was a nice plus, but not overwhelmingly amazing. We'll see if we take full advantage of that or not.

D. Citi American Airlines Business Mastercard ($95 annual fee)

While my mother had the Citi personal card version, my father had also applied for the Citi business card version at the same time last February. While the sign up bonus at the time was only 35,000 AA miles, it was the best Citi business card offer at the time, so he decided to apply for it anyway.

While my mother had the Citi personal card version, my father had also applied for the Citi business card version at the same time last February. While the sign up bonus at the time was only 35,000 AA miles, it was the best Citi business card offer at the time, so he decided to apply for it anyway.

Similar to before, the benefits of this Citi AA card was also 100% duplicative with the personal card versions, so there was little reason to keep the card if we had to pay another fee. However, since it was a business card, the available credit didn't count for my father's personal credit score. So keeping it or closing it, wouldn't impact it at all.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee. I'd like to close the account before the fee hits."

Rep: "I see, well, we do have other no fee cards that we can convert this into, including our Thank You card where you'd earn Thank You points. That one has no fee. I can transfer you to our specialist to handle that for you."

Father: "Hmm, are there any other options?"

Rep: "You can close the account outright."

Father: (after some thinking about converting the card) "Actually, I think I'd to close the account." My father actually wanted to be transferred to the specialist who would have the authority to make additional (better) retention offers. Then if he had to, he would close the account. While he thought about downgrading to the no-fee Thank You business card, he opted against that since it would then make him ineligible for getting a sign up bonus on that card later on.

Rep: "OK, let me transfer you to the specialist."

After a 2 minute hold, the original representative got back on the line.

Rep: "There wasn't a specialist available, but I have authorization to close the account, so I've done that for you. Do you have any other things I can help you with? "

Father: "No, I'm all set. Thank you."

While not the ideal outcome, my father wasn't too concerned about the account closure since he was 100% prepared to cancel the card anyway. But lesson learned that sometimes when you play chicken, you can lose.

E. Barclays US Airways Mastercard ($89 annual fee)

My father signed up for this card because (a) it was a Barclays card and we had too many Chase/Citi/Amex cards, (b) US Airways was set to merge with American Airlines and the miles would be consolidated and (c) there was times when flying US Airways was our best option since they were currently in the Star Alliance with United and we could credit the miles to United or Aegean Airlines.

My father signed up for this card because (a) it was a Barclays card and we had too many Chase/Citi/Amex cards, (b) US Airways was set to merge with American Airlines and the miles would be consolidated and (c) there was times when flying US Airways was our best option since they were currently in the Star Alliance with United and we could credit the miles to United or Aegean Airlines.

In addition to the 2x on US Airways purchases, the card also offered priority check in and priority boarding (but no free checked bags). The other perks were a set of $99 Companion Pass and Lounge Passes. We ended up using the $99 Companion passes for a flight to Austin last month but ended up never needing the lounge passes (which will expire at the end of this month) because we got access to the US Airways lounges using our expired American Express Platinum cards.

For paying the $89 annual fee this month, we'll get another set of Companion Passes and Lounge Passes, but now that US Airways will leave the Star Alliance on March 30th, we'd no longer be able to credit our flights to United or Aegean. Thus, no more reason to fly US Airways. Upon reading reports, it seemed that many Barclay representatives were willing to waive the $89 fee with little/no discussion. So my father was hopeful.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee soon. I'd like to close the account before the fee hits, because I'm not sure what will happen to this card after the American-US Airways merger."

Rep: "I see that the charge will be posted on February 28th. I can transfer you to the specialist who will be better suited to explain everything about the merger."

Specialist: "Hi, sir, let me first tell you about the merger. The merger was completed late last year but the airlines will continue to operate independently for another year. Accordingly, their frequent flyer programs will also continue to be independent through 2014 and will be combined sometime in 2015. As such, Barclay will continue to service this US Airways card for the next year. But if you'd like to avoid the fee, I can permanently eliminate the fee on the card. You will continue to earn US Airway miles."

Father: "Really? So no fee ever?"

Rep: "That's correct."

Father: "Wait a minute. Will I still have the same version of the card or will I be getting a new card with different benefits?"

Rep: "You will no longer get the companion passes or priority boarding..."

Father: "But will I still earn 2x miles on US Airways purchases?"

Rep: "You will have the opportunity to continue accelerating your mileage balance through spending."

Father: "But will I still earn 2x miles on US Airways purchases?"

Rep: "You will earn 1 mile for each dollar spent on US Airways. You will earn 1 mile for each 2 dollars spent on other spending."

Father: "OK, let me think about it. I'll call you back."

But thinking further through this situation, we would ultimately give up and convert to the no-fee card if we had to, because it would keep an active account with Barclay (who is starting to offer some interesting new travel reward cards including the Arrival Card). Barclay is known to evaluate historical customer relationship length and card activity to approve new applicants. A 1 year history of opening/closing the one Barclay card wouldn't help his case for another future approval.

But thinking further through this situation, we would ultimately give up and convert to the no-fee card if we had to, because it would keep an active account with Barclay (who is starting to offer some interesting new travel reward cards including the Arrival Card). Barclay is known to evaluate historical customer relationship length and card activity to approve new applicants. A 1 year history of opening/closing the one Barclay card wouldn't help his case for another future approval.

These cards fall into the same category, so we'll discuss them at the same time. My mother applied for the Sapphire Preferred Visa in February 2012 and already paid the $95 annual fee in 2013 because we needed at least one premium Chase Ultimate Reward card open to transfer to United or Hyatt. But this year, we had her Chase Ink Bold Mastercard as well as my father's Chase Sapphire Preferred card. Therefore, she was hoping to avoid paying another $95.

These cards fall into the same category, so we'll discuss them at the same time. My mother applied for the Sapphire Preferred Visa in February 2012 and already paid the $95 annual fee in 2013 because we needed at least one premium Chase Ultimate Reward card open to transfer to United or Hyatt. But this year, we had her Chase Ink Bold Mastercard as well as my father's Chase Sapphire Preferred card. Therefore, she was hoping to avoid paying another $95.

However, with the Sapphire Preferred, at the end of each cardmember year, we'd receive a 7% dividend on the UR points earned over the prior 12 months. So that's an additional 3,500+ UR points we are due in a few weeks. Since the annual fee didn't actually post yet, we would still have a few months to cancel the card without paying the fee.

Similarly, my father's Chase Hyatt Card offers an annual certificate for a free night at any Category 1-4 Hyatt hotel. I'd bet that my father would be able to find a hotel that would be worth more than the $75 annual fee, but it wouldn't be worth making a special trip just to redeem the certificate. Also, since we live in Manhattan where all the Hyatt hotels are Category 5 or 6, we couldn't use the certificate for friends/family to visit us either. But we'd rather have the certificate than not, so we'll wait a few weeks before cancelling to avoid the fee.

The ongoing benefit of the card is that it gives my father Hyatt Platinum status for as long as he has the card, but (a) Hyatt Diamond status is the top tier level you'd want, (b) we already earned Platinum status for 2014 from our 2013 stays and (c) we're focusing our hotel activity towards Starwood to keep top-tier status there. But who knows, maybe Chase will offer us a compelling retention offer to keep the card another year.

So for making a few phone calls this morning, my father got us:

Big warning! If you have any outstanding debt at all (student loans, credit card, personal loans or mob gambling debt), then you're better off not opening more credit cards, because you're probably spending more than you're making and ruining your future. The interest charges alone will destroy any point/mile value you may receive. The last thing you need is another credit card.

While the miles/points game can allow an ordinary person to stretch their limited dollars to travel well beyond their usual means, it is definitely not a "free" game to play. For example:

1. Round trip business class flights to Europe this summer using United miles still cost us $163/person in taxes (vs. retail $4,000+/person).

2. 6 night stay at the Conrad Koh Samui in Thailand was all on Hilton points, but we still had to pay overpriced hotel prices for our daily meals on the property which came out to about $25/person per meal (vs. retail $850/night x 6 nights for the room).

3. Having over 20 active credit cards currently open that all offered a lucrative sign up bonus (50,000-100,000 miles/points) as well as bonus spending categories (2x-5x per dollar charged) gets us a lot of loyalty program currency, but many of these cards also charge $95+ annual fees after the 1st year. Assuming half of our cards have annual fees, that's ~$950 in fees for the privilege of using them for another 12 months.

Of course, there's not much my father can do about the cash cost for #1 and #2, but he can mitigate much of #3 by just getting a hold of the Credit Card Retention representatives.

There's a lot of discussion in the blogosphere about credit card Sign Ups. That's primarily because the bloggers get paid by the credit card companies to get people to sign up for their cards. Not me of course - I'm only 2 years old. I only talk about the cards that my parents sign up for and/or use for illustrative purposes. I don't really care if you get a card or not.

There's a lot of discussion in the blogosphere about credit card Sign Ups. That's primarily because the bloggers get paid by the credit card companies to get people to sign up for their cards. Not me of course - I'm only 2 years old. I only talk about the cards that my parents sign up for and/or use for illustrative purposes. I don't really care if you get a card or not.But while there's a lot of public attention around the card sign up, there's little said about the other end of the spectrum - the card cancellation. This end is where my father's OCD nature gets us the proverbial "second bite at the apple."

February 2014 Cancellations

Last February, my parents had their Credit Card Churn (signing up for a lot of credit cards at the same time).

- Some of these new cards were No Fee cards, which meant we could keep them open forever.

- However, many were only waiving the annual fee for the first year, then $95/year each and they weren't worth keeping for another year if we had to pay the fee.

- In addition, there were a few reward cards we had for a few years because they were great to keep around, even after paying the fee.

A. Starwood Preferred Guest Amex ($65 annual fee)

If you've been reading LCD for a while, you'll know that this card is my father's all time favorite. He uses this for all his non-bonus spending (anyplace where he would only earn 1x points). It's really the only way to accumulate a significant number of SPG points, because actually staying a night at a Starwood hotel doesn't get you that many points.

He's had this card since 2009 and has been paying the $65 annual fee since 2010 (after his 1st year). For him, it's been worth it because he accumulates SPG points, gets 2 stays/5 night credit towards his SPG elite status each year and is an American Express card. As you may know, Amex often runs several amazing promotions each year (such as Small Business Saturday) that will save you significant money, especially since the promotions are available to each unique Amex card (even if the cards are authorized users under the 1 master account). Since we have 3 authorized users under my father's account, we get the promotional benefit 3x, even though we pay just one $65 annual fee.

But on February 2, the 2014 annual fee posted to his account. While he had NO real intentional of cancelling the card, he called the number on the back of his SPG Amex and got an account representative.

Father: "I just got charged the $65 annual fee. I'm not sure I'll use the card enough this year to be worth the fee. I think I'd like to cancel."

Rep: "I see, well, you've had the card since 2009 and you've been using it quite actively. Let me transfer you to our account specialist who can see what they can do for you."

Specialist: "Sir, this is one of the best cards for earning points and miles. It's the only card that allows you to transfer points to both American Airlines and Delta at a 1:1 ratio. And also, if you transfer in increments of 20,000 points, you get an additional 5,000 miles, which is a 1.25x ratio."

Father: "I understand, but I'm not sure that's worth paying the annual fee for. I've actually been using other cards that offer me better bonuses (like 2x) on my spending."

Specialist: "Sir, I'd hate to lose your business. I can offer you a $25 statement credit to partially offset the fee."

Father: "Um, I'm not sure that's of interest to me. Is there anything else you can offer?"

Specialist: "Well, Starwood allows you to buy SPG points. $35 for 1,000 SPG points. Instead of the $25 statement credit, I can offer you 2,000 SPG points, which would be $70 if you purchased them yourself."

Father: "Wait, to be clear, are you offering me the ability to pay $70 for 2,000 SPG points?"

Specialist: "No, sir. Of course you could always just do that yourself if you wanted, the 2,000 points would be a gift for keeping the card another year."

Father: "And paying the $65 annual fee."

Specialist: "Yes, sir."

Father: (deliberate long pause) "OK, I'll take that offer."

So for a credit card that he planned to pay $65 for and keep another year anyway, he received a bonus 2,000 SPG points, which are worth $50-70 to us based on our usual 2.5-3.5 cents/pt redemption history.

B. Chase United Select ($95 annual fee)

This card was another of my father's long time favorites (since 2009). In addition to earning 3x United miles on United.com purchases, it also earned him 1x Premier Qualifying Miles (PQM) up to $5,000 on United.com purchases. Many times, this extra perk of 5,000 PQM was the difference between getting to that next tier of status (Platinum in 2013 and Gold in 2014). Plus, it earns 2x on gas, groceries and restaurants and already comes with an automatic 5,000 United mile annual bonus each year you keep the card. And the fact that this card is no longer offered anymore makes it all that much more special to my father.

So under no circumstances would he ever cancel this card. However, we wanted to see if he'd be offered a retention bonus as well, so he played a little game of credit card chicken.

Father: "I just got charged the $95 annual fee. I'd like to cancel."

Rep: "I see, well, you have an outstanding balance of $XXX. Let me transfer you to a specialist."

Specialist: "Sir, I understand you'd like to close the account. I just want to remind you that this card is a great one for earning United miles. We don't offer this card anymore. As you know, you can 3x on United purchases as well as 2x on gas, groceries, home improvement stores. It also comes with 5,000 annual bonus miles which we've already sent to your account. In fact, this past statement you've earned over 24,000 United miles."

Father: "I understand, but I've been starting to use other cards for my travel spending, including many of your own Chase cards like the Sapphire Preferred"

Specialist: "Wow, yes, I see that you have several cards with us. Well, we'd hate to close your account so perhaps I can look in my system to see what promotions you're eligible for... I can offer you 2 additional United Club passes good for 6 months."

Father: "Um, I actually already have United club access for being a United frequent flyer. Is there anything else you can offer?"

Specialist: "Well, I can offer you an additional 5,000 United miles. If you wanted to purchase that yourself, it would be well over $100 cost."

Father: (deliberate long pause) "Wow, OK. That's very generous. I'll take that offer."

So for another card that he was already willing to pay the $95 fee for, he received another free 5,000 United miles, worth about $100 to us, especially since my father's United account was wiped out after our redemption last week.

C. Citi American Airlines American Express ($95 annual fee)

Unlike the first two, this card was completely expendable after we earned 50,000 American Airline miles for the initial sign up a year ago. This card was my mother's account, and my father already had one in his account. So no need for duplicate benefits (free checked bags, priority boarding) for the same airline that we hardly fly anyway.

Unlike the first two, this card was completely expendable after we earned 50,000 American Airline miles for the initial sign up a year ago. This card was my mother's account, and my father already had one in his account. So no need for duplicate benefits (free checked bags, priority boarding) for the same airline that we hardly fly anyway.Of course, we'd gladly keep the card if the $95 fee were waived or we received an offer worth more than the fee. Since we don't really fly American Airlines, it's hard to keep my mother's AAdvantage account active without doing something excessive (buying something we don't need or donating miles). Otherwise, after 18 months of inactivity, the account closes and the miles are wiped out. But spending a bit on the card every so often adds miles to her AAdvantage account and resets the expiration date by another 18 months.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee. I'd like to close the account before the fee hits."

Rep: "I see, well, you have 30 days after the fee actually posts to cancel without paying it, but let me transfer you to a specialist."

Specialist: "Sir, I understand you'd like to close the account. [insert review of the card benefits here] "

Father: "I understand, but I'm not sure I want to pay another $95 annual fee."

Specialist: "Well, let me see what promotions we're offering. I can offer you a 2 part promotion. First, we give you a $95 statement credit which will offset the fee, but you have to still pay the fee normally. The statement credit will automatically be processed. Second, there's a special bonus offer for an extra 1,000 AA miles for each month that you spend at least $1,000 for the next 16 billing statements."

Father: "So what happens if I spend $1,000 in March, but then the $95 statement credit posts, bringing my total below $1,000."

The Specialist repeated the original terms verbatim, but didn't actually answer the question. After 2 iterations, she finally understood.

Specialist: "Oh I see, well, you'd still get the 1,000 mile bonus" (but she sounded very uncertain)

Father: "Well, OK. I'll take that offer."

Since there was a $95 statement credit to offset the fee, keeping the card for another year was a no brainer. It gave my mother an easy way to keep her AAdvantage account active as well as retained a lot of Available Credit with Citi, so that we could use it as leverage to trade in when we applied for future Citi cards. The fact that we'd essentially earn 2x AA miles for $1,000 of spending each month was a nice plus, but not overwhelmingly amazing. We'll see if we take full advantage of that or not.

D. Citi American Airlines Business Mastercard ($95 annual fee)

While my mother had the Citi personal card version, my father had also applied for the Citi business card version at the same time last February. While the sign up bonus at the time was only 35,000 AA miles, it was the best Citi business card offer at the time, so he decided to apply for it anyway.

While my mother had the Citi personal card version, my father had also applied for the Citi business card version at the same time last February. While the sign up bonus at the time was only 35,000 AA miles, it was the best Citi business card offer at the time, so he decided to apply for it anyway.Similar to before, the benefits of this Citi AA card was also 100% duplicative with the personal card versions, so there was little reason to keep the card if we had to pay another fee. However, since it was a business card, the available credit didn't count for my father's personal credit score. So keeping it or closing it, wouldn't impact it at all.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee. I'd like to close the account before the fee hits."

Rep: "I see, well, we do have other no fee cards that we can convert this into, including our Thank You card where you'd earn Thank You points. That one has no fee. I can transfer you to our specialist to handle that for you."

Father: "Hmm, are there any other options?"

Rep: "You can close the account outright."

Rep: "OK, let me transfer you to the specialist."

After a 2 minute hold, the original representative got back on the line.

Rep: "There wasn't a specialist available, but I have authorization to close the account, so I've done that for you. Do you have any other things I can help you with? "

Father: "No, I'm all set. Thank you."

While not the ideal outcome, my father wasn't too concerned about the account closure since he was 100% prepared to cancel the card anyway. But lesson learned that sometimes when you play chicken, you can lose.

E. Barclays US Airways Mastercard ($89 annual fee)

My father signed up for this card because (a) it was a Barclays card and we had too many Chase/Citi/Amex cards, (b) US Airways was set to merge with American Airlines and the miles would be consolidated and (c) there was times when flying US Airways was our best option since they were currently in the Star Alliance with United and we could credit the miles to United or Aegean Airlines.

My father signed up for this card because (a) it was a Barclays card and we had too many Chase/Citi/Amex cards, (b) US Airways was set to merge with American Airlines and the miles would be consolidated and (c) there was times when flying US Airways was our best option since they were currently in the Star Alliance with United and we could credit the miles to United or Aegean Airlines.In addition to the 2x on US Airways purchases, the card also offered priority check in and priority boarding (but no free checked bags). The other perks were a set of $99 Companion Pass and Lounge Passes. We ended up using the $99 Companion passes for a flight to Austin last month but ended up never needing the lounge passes (which will expire at the end of this month) because we got access to the US Airways lounges using our expired American Express Platinum cards.

For paying the $89 annual fee this month, we'll get another set of Companion Passes and Lounge Passes, but now that US Airways will leave the Star Alliance on March 30th, we'd no longer be able to credit our flights to United or Aegean. Thus, no more reason to fly US Airways. Upon reading reports, it seemed that many Barclay representatives were willing to waive the $89 fee with little/no discussion. So my father was hopeful.

Father: "I opened this card about a year ago and I know I'll be charged the $95 annual fee soon. I'd like to close the account before the fee hits, because I'm not sure what will happen to this card after the American-US Airways merger."

Rep: "I see that the charge will be posted on February 28th. I can transfer you to the specialist who will be better suited to explain everything about the merger."

Specialist: "Hi, sir, let me first tell you about the merger. The merger was completed late last year but the airlines will continue to operate independently for another year. Accordingly, their frequent flyer programs will also continue to be independent through 2014 and will be combined sometime in 2015. As such, Barclay will continue to service this US Airways card for the next year. But if you'd like to avoid the fee, I can permanently eliminate the fee on the card. You will continue to earn US Airway miles."

Father: "Really? So no fee ever?"

Rep: "That's correct."

Father: "Wait a minute. Will I still have the same version of the card or will I be getting a new card with different benefits?"

Rep: "You will no longer get the companion passes or priority boarding..."

Rep: "You will have the opportunity to continue accelerating your mileage balance through spending."

Rep: "You will earn 1 mile for each dollar spent on US Airways. You will earn 1 mile for each 2 dollars spent on other spending."

Father: "OK, let me think about it. I'll call you back."

The lesson here is that my father knew enough of the playbook to ask the right follow up questions. He was actually being offered to downgrade to a lower tier card (albeit a no fee card), but it was presented in a sneaky way to make it sound like the annual fee was simply being waived on his premium card. He decided to just call back later and hopefully get a new specialist who may be able to waive the fee on the higher end US Airways Mastercard he currently has. Additionally, by waiting until Feb 26 (the annual fee will post Feb 28), he will receive 10,000 anniversary US miles. While he doesn't plan on needing the US Airways benefits, he'd rather have it than not if it's free for another year.

But thinking further through this situation, we would ultimately give up and convert to the no-fee card if we had to, because it would keep an active account with Barclay (who is starting to offer some interesting new travel reward cards including the Arrival Card). Barclay is known to evaluate historical customer relationship length and card activity to approve new applicants. A 1 year history of opening/closing the one Barclay card wouldn't help his case for another future approval.

But thinking further through this situation, we would ultimately give up and convert to the no-fee card if we had to, because it would keep an active account with Barclay (who is starting to offer some interesting new travel reward cards including the Arrival Card). Barclay is known to evaluate historical customer relationship length and card activity to approve new applicants. A 1 year history of opening/closing the one Barclay card wouldn't help his case for another future approval.

E. Chase Sapphire Preferred Visa ($95 annual fee)

F. Chase Hyatt Visa ($75 annual fee)

These cards fall into the same category, so we'll discuss them at the same time. My mother applied for the Sapphire Preferred Visa in February 2012 and already paid the $95 annual fee in 2013 because we needed at least one premium Chase Ultimate Reward card open to transfer to United or Hyatt. But this year, we had her Chase Ink Bold Mastercard as well as my father's Chase Sapphire Preferred card. Therefore, she was hoping to avoid paying another $95.

These cards fall into the same category, so we'll discuss them at the same time. My mother applied for the Sapphire Preferred Visa in February 2012 and already paid the $95 annual fee in 2013 because we needed at least one premium Chase Ultimate Reward card open to transfer to United or Hyatt. But this year, we had her Chase Ink Bold Mastercard as well as my father's Chase Sapphire Preferred card. Therefore, she was hoping to avoid paying another $95.However, with the Sapphire Preferred, at the end of each cardmember year, we'd receive a 7% dividend on the UR points earned over the prior 12 months. So that's an additional 3,500+ UR points we are due in a few weeks. Since the annual fee didn't actually post yet, we would still have a few months to cancel the card without paying the fee.

Similarly, my father's Chase Hyatt Card offers an annual certificate for a free night at any Category 1-4 Hyatt hotel. I'd bet that my father would be able to find a hotel that would be worth more than the $75 annual fee, but it wouldn't be worth making a special trip just to redeem the certificate. Also, since we live in Manhattan where all the Hyatt hotels are Category 5 or 6, we couldn't use the certificate for friends/family to visit us either. But we'd rather have the certificate than not, so we'll wait a few weeks before cancelling to avoid the fee.

The ongoing benefit of the card is that it gives my father Hyatt Platinum status for as long as he has the card, but (a) Hyatt Diamond status is the top tier level you'd want, (b) we already earned Platinum status for 2014 from our 2013 stays and (c) we're focusing our hotel activity towards Starwood to keep top-tier status there. But who knows, maybe Chase will offer us a compelling retention offer to keep the card another year.

So for making a few phone calls this morning, my father got us:

- 2,000 SPG points

- 5,000 United miles

- $95 statement credit + bonus opportunity for an extra 1,000 AA/month

- Avoided a $95 annual fee

Not a bad haul for 0 hard inquires on his credit report. Then for the other three cards with annual fees coming due soon, we'll let you know in a month!

Labels:

American Airlines,

Amex,

Barclays,

Chase,

Citi,

Credit Cards,

HowTo,

Starwood,

United,

US Airways

Location:

New York, NY, USA

Wednesday, January 22, 2014

Connecting Flights

Flight #76/77 – US Airways

Austin (AUS) – New York (LGA) via CLT

Sunday, January 19, 2014

Depart: 11:51AM / Arrive: 5:52PM (Scheduled)

Duration: 5 hr 1 min

Aircraft: CRJ 900 / Airbus 319

Seat: Row 13A, 13B and 13C (Economy)

Earned: 1,576 miles

Cost: $254 / person (round trip)

Lifetime Miles: 142,469 miles

I'm fortunate enough to live in the BEST city in the world. In fact, it's so great that there are three well-trafficked airports serving New York City (JFK, LGA and EWR). And furthermore, EWR is a primary hub airport for United Airlines. That means that I can almost fly anywhere in the United States, most large European cities and the major Asian cities on direct non-stop flights.

However for many of us (especially those outside the main hub airport cities), there are times when the destination isn't served by a single direct flight. Connections can add a lot of frequent flyer miles and oftentimes bring down the cost of your airfare, but they can also often cause you to spend a lot of extra time in transit or worse, stuck at the airport if you happen to miss your connecting flight.

Background

Our return trip coming back from Austin was one of those risky connecting flights where there wasn't much room for error. We were scheduled to land at CLT at 3:19PM and our departing flight to LGA was scheduled to depart at 4:09PM, meaning they would start boarding at 3:39PM (just 20 minutes after our first flight was scheduled to land on the runway (not even dock at the arrival gate)!

Normally, my father thinks through these types of scenarios before booking the flights and plans accordingly. This time, however, he decided to risk the tight connection in Charlotte, because (a) he knew that CLT was a US Airways hub airport so there were several other flights to New York that afternoon and (b) we were flying in on Sunday and still had Monday (MLK Day) as a buffer in case we somehow weren't able to get on another flight that day. An extra night in Charlotte might not be so bad (especially since I've yet to visit anything other than Gate 15 of their airport).

Flight Delayed

Flight Delayed

Around 8AM the morning of our flight, my father received an alert on his Blackberry Travel App letting us know that our first 11:51AM flight was delayed by 25 minutes and wouldn't land in Charlotte until 3:45PM at gate E15.

Even at 2 years old, I realized that we would not have enough time to (a) taxi to the gate, (b) get off our plane, then (c) run to gate C10 (an entirely different airport concourse) with enough time to make our next flight that would stop boarding at 3:59PM.

I told my father to be proactive, so he went online to USAirways.com and looked up our itinerary. Of course, US Airways still had our flight being "On Time," but my father knew better than to go against Blackberry Travel, which always seemed to have better & quicker information than what the airlines choose to publicize.

Next, my father went on ITA Matrix to search for all afternoon flights from CLT to LGA (on both US Airways and other carriers) before he called US Airways to change our connecting flight. Why? Because he wanted to know what our alternate flight options were in case the US Airways agent had less than perfectreasoning ability information. He then went back to USAirways.com to see if they were still selling 3 seats on any of those afternoon flights. Everything was sold out until the 6:45PM flight.

Armed with some viable options, he then called US Airways (which he has programmed in his phone along with all the other airlines) and inquired about the flight status of his itinerary. Upon looking closer, the agent saw that the first flight was showing Delayed and that our connection might be too tight. She then gave us a second reservation on the 5:46PM flight so that we could still try to make the 4:09PM flight, but if not, we had a reservation on the 5:46PM flight. In this scenario, we'd have reservations on BOTH flights just in case.

If you're not familiar with traveling, this "solution" may sound like it would work out, but we knew better.

By doing it this way, we would give up our seats on the earlier 4:09PM flight, but we would confirm our tickets and secure seat assignments on the 6:45PM flight. After a few minutes on hold for the US Airways agent to make the change, we were all set by 8:15AM and on our way to our free breakfast downstairs at the Westin Austin.

You Have Chosen Wisely

Now at the Austin airport we could check in my car seat and our larger bag (for free due to Star Alliance Gold status through his United Platinum status) and just pick them up in New York. Then we'd have about 2 hours to have an early dinner and relax at CLT airport between our flights. No frantic rushing or worrying. Plus, CLT Airport was a US Airways hub airport, so there were several US Airways Club Lounges we could access using either:

At the end of the day, everything went as planned. We checked my car seat and large bag and had enough time to relax in the United lounge at AUS Airport before boarding our first flight. Then in the Charlotte airport, we enjoyed some mediocre Mexican food and virgin margaritas at one of the airport restaurants before going into the US Airways Club Lounge to watch the Broncos-Pats game. Our second flight departed on time and even had in-flight wifi available for $6.95. Our bags made it to LGA safe and sound and we were home by 9:30PM.

Summary Advice

Austin (AUS) – New York (LGA) via CLT

Sunday, January 19, 2014

Depart: 11:51AM / Arrive: 5:52PM (Scheduled)

Duration: 5 hr 1 min

Aircraft: CRJ 900 / Airbus 319

Seat: Row 13A, 13B and 13C (Economy)

Earned: 1,576 miles

Cost: $254 / person (round trip)

Lifetime Miles: 142,469 miles

I'm fortunate enough to live in the BEST city in the world. In fact, it's so great that there are three well-trafficked airports serving New York City (JFK, LGA and EWR). And furthermore, EWR is a primary hub airport for United Airlines. That means that I can almost fly anywhere in the United States, most large European cities and the major Asian cities on direct non-stop flights.

However for many of us (especially those outside the main hub airport cities), there are times when the destination isn't served by a single direct flight. Connections can add a lot of frequent flyer miles and oftentimes bring down the cost of your airfare, but they can also often cause you to spend a lot of extra time in transit or worse, stuck at the airport if you happen to miss your connecting flight.

Background

Our return trip coming back from Austin was one of those risky connecting flights where there wasn't much room for error. We were scheduled to land at CLT at 3:19PM and our departing flight to LGA was scheduled to depart at 4:09PM, meaning they would start boarding at 3:39PM (just 20 minutes after our first flight was scheduled to land on the runway (not even dock at the arrival gate)!

Normally, my father thinks through these types of scenarios before booking the flights and plans accordingly. This time, however, he decided to risk the tight connection in Charlotte, because (a) he knew that CLT was a US Airways hub airport so there were several other flights to New York that afternoon and (b) we were flying in on Sunday and still had Monday (MLK Day) as a buffer in case we somehow weren't able to get on another flight that day. An extra night in Charlotte might not be so bad (especially since I've yet to visit anything other than Gate 15 of their airport).

Flight Delayed

Flight DelayedAround 8AM the morning of our flight, my father received an alert on his Blackberry Travel App letting us know that our first 11:51AM flight was delayed by 25 minutes and wouldn't land in Charlotte until 3:45PM at gate E15.

Even at 2 years old, I realized that we would not have enough time to (a) taxi to the gate, (b) get off our plane, then (c) run to gate C10 (an entirely different airport concourse) with enough time to make our next flight that would stop boarding at 3:59PM.

I told my father to be proactive, so he went online to USAirways.com and looked up our itinerary. Of course, US Airways still had our flight being "On Time," but my father knew better than to go against Blackberry Travel, which always seemed to have better & quicker information than what the airlines choose to publicize.

Next, my father went on ITA Matrix to search for all afternoon flights from CLT to LGA (on both US Airways and other carriers) before he called US Airways to change our connecting flight. Why? Because he wanted to know what our alternate flight options were in case the US Airways agent had less than perfect

Armed with some viable options, he then called US Airways (which he has programmed in his phone along with all the other airlines) and inquired about the flight status of his itinerary. Upon looking closer, the agent saw that the first flight was showing Delayed and that our connection might be too tight. She then gave us a second reservation on the 5:46PM flight so that we could still try to make the 4:09PM flight, but if not, we had a reservation on the 5:46PM flight. In this scenario, we'd have reservations on BOTH flights just in case.

If you're not familiar with traveling, this "solution" may sound like it would work out, but we knew better.

- First, having a reservation isn't the same thing as being ticketed (confirmed) with seat assignments. We'd essentially be going standby on the 5:46PM flight, meaning we'd only get ticketed if there were seats available. Assuming we weren't the only ones connecting, there may have been a mad rush for the seats on that flight, and we don't have any frequent flyer status/priority on US Airways.

- Second, we had a some luggage with us (including my car seat) that we could choose to either (a) check in or (b) carry on. This "solution" of double reservations pretty much meant that we could NOT check-in our car seat, because the baggage team would have NO idea if we were on the 4:09PM flight or the 5:46PM flight. In fact, given the tight connection, there was no way they'd be able to transfer onto the 4:09PM flight at all. So that meant we'd have to bring everything as a carry-on, which would make it that much harder for us to transfer all the way from Gate E15 to Gate C10 (as shown on the map above).

- And finally (and most importantly), my father already saw that the 5:46PM flight was sold out per USAirways.com.

By doing it this way, we would give up our seats on the earlier 4:09PM flight, but we would confirm our tickets and secure seat assignments on the 6:45PM flight. After a few minutes on hold for the US Airways agent to make the change, we were all set by 8:15AM and on our way to our free breakfast downstairs at the Westin Austin.

You Have Chosen Wisely

Now at the Austin airport we could check in my car seat and our larger bag (for free due to Star Alliance Gold status through his United Platinum status) and just pick them up in New York. Then we'd have about 2 hours to have an early dinner and relax at CLT airport between our flights. No frantic rushing or worrying. Plus, CLT Airport was a US Airways hub airport, so there were several US Airways Club Lounges we could access using either:

- Our cancelled Platinum American Express cards that we kept for this exact reason even after closing the accounts;

- My parents' Star Alliance Gold cards from foreign Star Alliance airlines (Aegean and Turkish); or

- Our two US Airways lounge passes that came free with our Barclays US Airways credit card that we applied for in Feb 2013.

At the end of the day, everything went as planned. We checked my car seat and large bag and had enough time to relax in the United lounge at AUS Airport before boarding our first flight. Then in the Charlotte airport, we enjoyed some mediocre Mexican food and virgin margaritas at one of the airport restaurants before going into the US Airways Club Lounge to watch the Broncos-Pats game. Our second flight departed on time and even had in-flight wifi available for $6.95. Our bags made it to LGA safe and sound and we were home by 9:30PM.

Summary Advice

- Use an App. It was key that we used a trip monitoring app such as Blackberry Travel that alerted us for flight delays before the airline notified us. If you're not a prehistoric smartphone user, then we recommend TripIt available on iPhones and Android.

- Have a BackUp Plan. We knew that there were multiple flight alternatives back to LGA (and even more to JFK or EWR). These were available to us because we didn't book the last flight of the night or the last day of a long weekend.

- Be Proactive. Checking available options BEFORE calling the airline. It's always good to know your options to feed the agent instead of relying on their concern for your well being.

- Think Through the Implications. Switching (and committing) to the later flight allowed us to check our bags and secure good seat assignments in advance (I love my window seats). We valued those features over getting home quicker and feeling rushed to get to the departure gate all the way across the airport.

Labels:

Airport,

US Airways

Location:

New York, NY, USA

Monday, January 13, 2014

US Airways $99 Companion Pass

Flight #74/75 – US Airways 2071/630

New York (LGA) – Austin (AUS) via CLT

Saturday, January 11, 2014

Depart: 8:43AM / Arrive: 2:11PM

Duration: 5 hr 24 min

Aircraft: Airbus 319

Seat: Row 13A, 13B and 13C (Economy)

Earned: 1,576 miles

Cost: $254 / person (round trip)

Lifetime Miles: 140,893 miles

My father had a few business meetings down in Texas this week, so my mother and I flew down with him to keep him company (or as my mother says, "to keep him out of trouble"). After all, years ago, when he went to Texas for his friend's 25th birthday party, my father ended up in cab full of strangers on a combo bachelor-bachelorette party heading to a "gentleman's club" where he proceeded to fall dead asleep in the corner. But I digress...

However, now that I've been forced to pay for my own seat on flights (now that I'm no longer considered a true lap child), my parents have started to find it quite expensive to travel around. Given we were flying back during Martin Luther King weekend in January, fares from NYC to AUS/SAT were running close to $300+ per person at the time we were booking.

Luckily for us, my father still had his US Airways $99 Companion passes from his February 2013 application for the Barclays US Airways Mastercard. However, like most things in life, this benefit came with strings!

1. Only for $250+ Fares. While $250 sounds like a reasonable price for the 1st ticket, you're probably assuming $250 includes taxes and fees. Nope. The $250 is for the base fare only. Most of the time, we have a lot of luck finding domestic flights that are closer to $200-220 in base fare, thereby keeping our total ticket under $300/person.

So when you're required to book a $250+ base fare, you're actually looking at a $300+ ticket all-in. Whenever we've tried to use this US Airways certificate in the past, we've been "successful" in finding either (a) US Airways fares that were too cheap to use the certificate for or (b) alternative airlines that ended up cheaper than had we used the certificate.

But for this particular LGA-AUS itinerary ($485 for the 1st person), the cheapest alternative fare (United for $286/person, or $857 total) ended up being higher than using the US Airways companion certificate for 2 companions ($763 total, or about $254/person).

While we did have to connect in Charlotte on both the outbound and the return, the US Airways fares earned us 100% mileage on Aegean Airlines (vs. only 50% on United), so that we'd be closer to reachingLifetime Star Alliance Gold Status with them.

2. Blackout Dates. As you can see in the certificate image above, there's a handful of 2014 holiday weekend dates that this perk cannot be used for, including Jan 3-5, Feb 14, Mar 16, 23, Apr 13, 27, May 22-23, Jun 19-20, 22, 26-27, Jul 6-7, 27, Aug 3, Oct 10, 19, Nov 30, Dec 1, 19-20, 26-28.

There were also some other city-specific blackout dates:

3. Calling In to Book. As the certificate states, you need to use this certificate by calling the US Airways call center at 1-800-428-4322. This is considered a negative, because my family likes using computers and doing things ourselves online as a general rule in the Songer household. Not because we're anti-social or don't like interacting with people, but because there's a smaller chance of anything going wrong.

As you older toddlers know from playing the Telephone Game in preschool, the original message almost always gets distorted by the time it reaches the final person. As such, booking airline tickets over the phone can be a high-risk exercise, especially when atypical first names are throw into the mix. Note: Fortunately, US Airways doesn't outsource its call centers to foreign countries, so you can rest assured that you will reach someone who speaksperfect American English.

4. Paper Certificate. Unlike many other benefits in today's electronic age, this perk from Mastercard required the actual paper certificate to be filled out and mailed in to:

US Airways - TBM

799 Hanes Mall Boulevard

Winston-Salem, NC 27103

After calling in to book the reservation, you have to write down the Confirmation Code provided by the phone agent and then promptly main in the certificate. They say you have 24 hours to mail the document, so we didn't want to find out what happens if we were late.

Conclusion

So in the end, we found a reasonable $254 average fare (not an amazing deal like you might have first expected) to a destination my father had to go to anyway. However, given that my father will be reimbursed up to $500 for his business related flight, makes paying cash for this trip a lot easier to swallow. Factoring that in, we're only out of pocket for $263 net, bringing our per person fare down to $88/person!

New York (LGA) – Austin (AUS) via CLT

Saturday, January 11, 2014

Depart: 8:43AM / Arrive: 2:11PM

Duration: 5 hr 24 min

Aircraft: Airbus 319

Seat: Row 13A, 13B and 13C (Economy)

Earned: 1,576 miles

Cost: $254 / person (round trip)

Lifetime Miles: 140,893 miles

My father had a few business meetings down in Texas this week, so my mother and I flew down with him to keep him company (or as my mother says, "to keep him out of trouble"). After all, years ago, when he went to Texas for his friend's 25th birthday party, my father ended up in cab full of strangers on a combo bachelor-bachelorette party heading to a "gentleman's club" where he proceeded to fall dead asleep in the corner. But I digress...

However, now that I've been forced to pay for my own seat on flights (now that I'm no longer considered a true lap child), my parents have started to find it quite expensive to travel around. Given we were flying back during Martin Luther King weekend in January, fares from NYC to AUS/SAT were running close to $300+ per person at the time we were booking.

Luckily for us, my father still had his US Airways $99 Companion passes from his February 2013 application for the Barclays US Airways Mastercard. However, like most things in life, this benefit came with strings!

1. Only for $250+ Fares. While $250 sounds like a reasonable price for the 1st ticket, you're probably assuming $250 includes taxes and fees. Nope. The $250 is for the base fare only. Most of the time, we have a lot of luck finding domestic flights that are closer to $200-220 in base fare, thereby keeping our total ticket under $300/person.

So when you're required to book a $250+ base fare, you're actually looking at a $300+ ticket all-in. Whenever we've tried to use this US Airways certificate in the past, we've been "successful" in finding either (a) US Airways fares that were too cheap to use the certificate for or (b) alternative airlines that ended up cheaper than had we used the certificate.

While we did have to connect in Charlotte on both the outbound and the return, the US Airways fares earned us 100% mileage on Aegean Airlines (vs. only 50% on United), so that we'd be closer to reaching

2. Blackout Dates. As you can see in the certificate image above, there's a handful of 2014 holiday weekend dates that this perk cannot be used for, including Jan 3-5, Feb 14, Mar 16, 23, Apr 13, 27, May 22-23, Jun 19-20, 22, 26-27, Jul 6-7, 27, Aug 3, Oct 10, 19, Nov 30, Dec 1, 19-20, 26-28.

There were also some other city-specific blackout dates:

- NYC and Las Vegas Jan 30-31, Feb 3-4 (for the Superbowl)

- New Orleans Feb 28, Mar 2, 5 (for Mardi Gras)

- Dallas Apr 3-4, 8 (NCAA Basketball Final Four)

- Louisville May 1-2, 4 (Kentucky Derby)

3. Calling In to Book. As the certificate states, you need to use this certificate by calling the US Airways call center at 1-800-428-4322. This is considered a negative, because my family likes using computers and doing things ourselves online as a general rule in the Songer household. Not because we're anti-social or don't like interacting with people, but because there's a smaller chance of anything going wrong.

As you older toddlers know from playing the Telephone Game in preschool, the original message almost always gets distorted by the time it reaches the final person. As such, booking airline tickets over the phone can be a high-risk exercise, especially when atypical first names are throw into the mix. Note: Fortunately, US Airways doesn't outsource its call centers to foreign countries, so you can rest assured that you will reach someone who speaks

4. Paper Certificate. Unlike many other benefits in today's electronic age, this perk from Mastercard required the actual paper certificate to be filled out and mailed in to:

US Airways - TBM

799 Hanes Mall Boulevard

Winston-Salem, NC 27103

After calling in to book the reservation, you have to write down the Confirmation Code provided by the phone agent and then promptly main in the certificate. They say you have 24 hours to mail the document, so we didn't want to find out what happens if we were late.

Conclusion

So in the end, we found a reasonable $254 average fare (not an amazing deal like you might have first expected) to a destination my father had to go to anyway. However, given that my father will be reimbursed up to $500 for his business related flight, makes paying cash for this trip a lot easier to swallow. Factoring that in, we're only out of pocket for $263 net, bringing our per person fare down to $88/person!

Thursday, January 9, 2014

Points & Miles Status Check

So it's always a good idea to take stock in your points/mile balances to see where you're at with your travel goals. Sometimes you'll realize you need just a few more points from one hotel or airline to achieve your travel award goals. Other times, you'll realize you have more than enough of one kind of "currency" so you'll shift your earning into other types.

My obsessive father likes to check every 2 minutes on his AwardWallet app, but most well-adjusted people probably check a few times a year. I realize that some people have literally millions of points in each category, so clearly we're not trying to show off our modest balances. But since we get some people asking us, I just wanted them to see what can be achieved in a year if you're smart about your work trips, family vacations, personal credit and daily spending.

So as of the beginning of this year, here's where my family stands in our combined reward points & mile balances (and this is after our crazy travel schedule in 2013 when we redeemed a lot of our points):

Airlines

But if you really needed a very conservative approximate $ value for your point totals, you can just assume $0.01 per point across the board to see how much you could redeem these points for (i.e., 294,024 IHG points = $2,940 of potential redemption value). But to be fair having 658 Amex MR is actually worth nothing because it's not enough to redeem for anything. And on the other side of the argument, my family has often been able to get anywhere from 2-5 cents/pt of value from many of our points (Starwood, United). So the only real takeaway is this: "If you can get points for free, might as well take them, because they're worth more than $0."

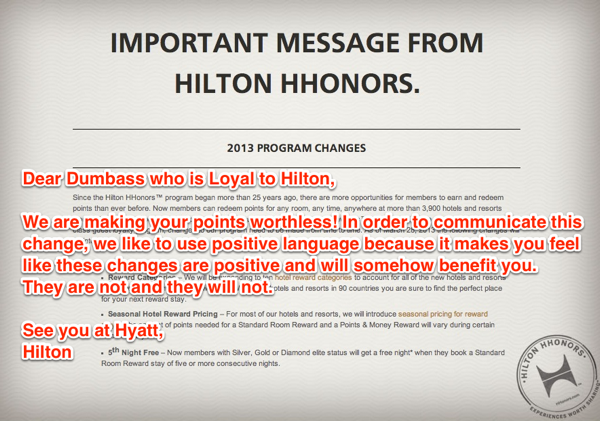

Of course, I have to warn you that at any point in time the Airline or Hotel program can suddenly decide to raise the prices of its free flight / night awards, thereby instantly reducing your precious points to a mere fraction of their prior value.

Such Devaluation, in fact, recently happened for most of these programs over the past few months, including United, Hyatt and especially Hilton (which raised the price of its awards by almost 100% in some cases).

Plus, loyalty reward point "currency" is literally worthless almost anywhere outside the particular program they're in (much like Disney Dollars).

My obsessive father likes to check every 2 minutes on his AwardWallet app, but most well-adjusted people probably check a few times a year. I realize that some people have literally millions of points in each category, so clearly we're not trying to show off our modest balances. But since we get some people asking us, I just wanted them to see what can be achieved in a year if you're smart about your work trips, family vacations, personal credit and daily spending.

So as of the beginning of this year, here's where my family stands in our combined reward points & mile balances (and this is after our crazy travel schedule in 2013 when we redeemed a lot of our points):

Airlines

- United Miles: 144,276 miles

- American Miles: 381,406 miles

- US Airways Miles: 38,920 miles

- British Airways: 121,700 miles

- Aegean Miles: 30,044 miles

- Starwood Points: 167,298 points

- IHG Points: 294,024 points

- Hyatt: 1,519 points

- Hilton: 39,670 points

- Chase Ultimate Rewards: 349,909 points

- Citi Thank You: 208,933 points

- American Express Membership Rewards: 658 points

But if you really needed a very conservative approximate $ value for your point totals, you can just assume $0.01 per point across the board to see how much you could redeem these points for (i.e., 294,024 IHG points = $2,940 of potential redemption value). But to be fair having 658 Amex MR is actually worth nothing because it's not enough to redeem for anything. And on the other side of the argument, my family has often been able to get anywhere from 2-5 cents/pt of value from many of our points (Starwood, United). So the only real takeaway is this: "If you can get points for free, might as well take them, because they're worth more than $0."

Of course, I have to warn you that at any point in time the Airline or Hotel program can suddenly decide to raise the prices of its free flight / night awards, thereby instantly reducing your precious points to a mere fraction of their prior value.